“Throw out the roadmap. Build a portfolio of instant pivots instead.” - Futurist Jim Carroll

Build options, not plans!

We are on Day 19 of this series and have covered a lot of ground. We’ve established the necessary foundation: the future is terrifyingly fast (Day 16), your only defense is being (Day 17), and you must adopt an "antifragile" mindset to feed on the chaos (Day 18).

The question today is this: How do you plan when you can’t predict? Or when what you predict doesn't happen because something else does. Or a trend is too complex

Welcome to the idea of Optionality Architecture. Instead of building a plan, build a series of pivots, so that you are ready for whatever the hell happens!

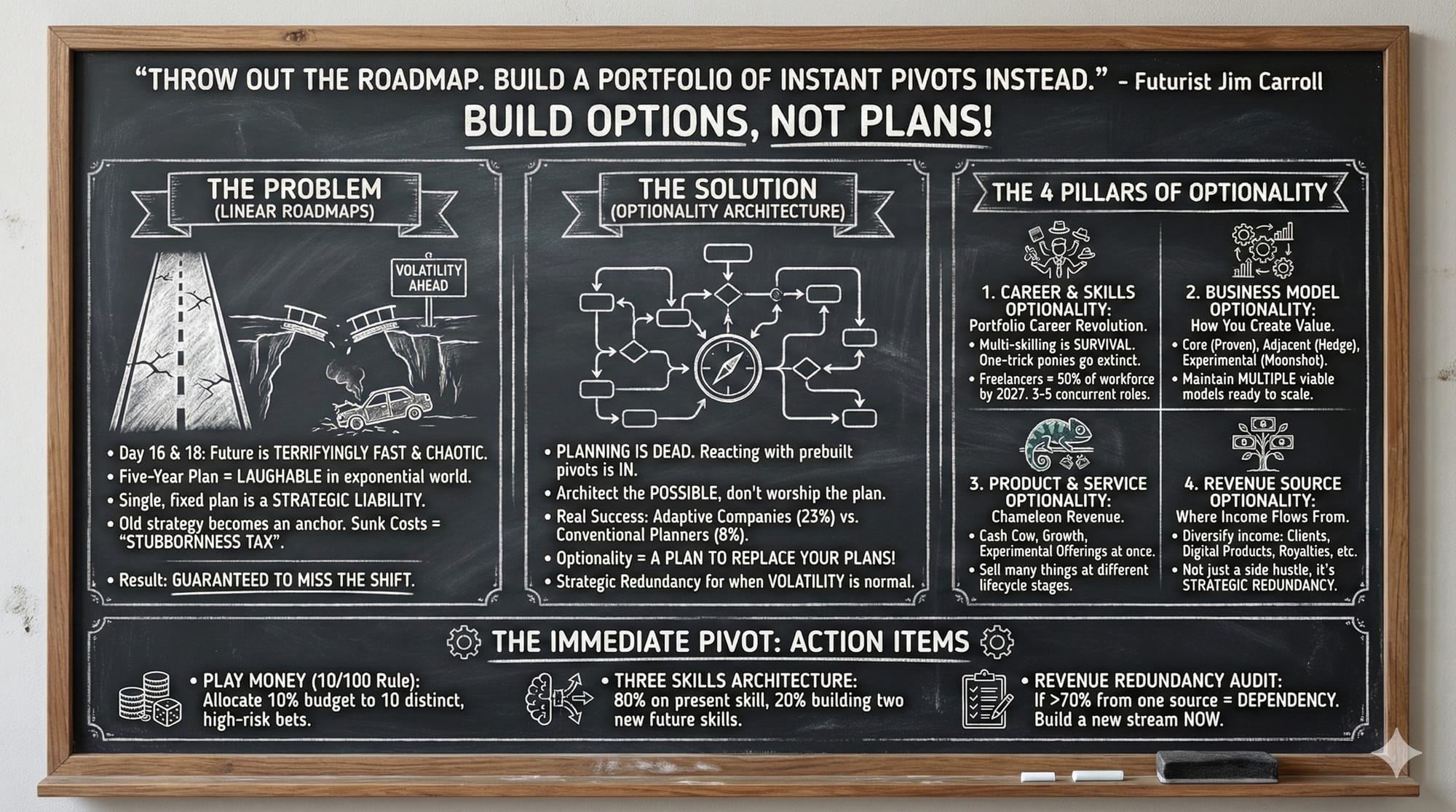

Here's your chalkboard summary!

Think about this idea. Planning is dead. Reacting with prebuilt plans is in.

Here's why.

In a linear world, the five-year plan was the gold standard. It was a single, rigid path based on the comforting (but false) assumption that the future would look mostly like the past. Strategy was about prediction and sticking to pre-determined plans.

A five-year plan today? Laughable! In an exponential world, a single, fixed plan is a strategic liability. The moment you commit to one path, a technology curve goes vertical, or a Black Swan event lands. The old strategy instantly becomes an anchor that guarantees you miss the shift.

The winning move is to stop worshipping the plan and start architecting the possible.

That's why the new principle you must master for 2026 and beyond is Optionality Architecture.

Beyond being a cool phrase that rolls off your tongue, it's a critical survival and success strategy you need to go forward. To get it, you must understand what it is.

It's knowing that your old way of planning for tomorrow is dead. Instead, it's knowing that your future can no longer be defined by a plan, but instead, by many plans.

Options.

This.

Digging into Optionality Architecture

Here's the brutal math from one study: Only 8% of companies using conventional planning models achieved real success during a period of volatility. Compare that to 23% for truly adaptive companies. The lesson? Plans don't work. Adaptability does.

And if our reality is that volatility is the new normal, it becomes pretty clear what we need to do.

It also means that the five-year plan isn't just an outdated idea from the olden days - it's an actual competitive disadvantage as well.

And here's what it implies - the idea of optionality isn't just a mindset. It's an architecture, a methodology, a plan to replace your plans! It's a deliberate structure you put in place so that you are ready for anything. Such as ... volatility being the new normal.

The most successful individuals and organizations in an exponential world don't just have options. They systematically construct portfolios of options across four critical areas of their future

- Career & Skills Optionality — Your personal capabilities portfolio

- Business Model Optionality — How you create and capture value

- Product & Service Optionality — What you offer to the market

- Revenue Source Optionality — Where your income flows from

Let's examine each.

Career & Skills Optionality: The Portfolio Career Revolution

We all know that the traditional career path - climbing the ladder at one company for decades - has become the exception rather than the rule. The data is unambiguous:

- The Shift Is Already Here:

- By 2030, half of all professionals will have portfolio careers (OECD forecast)

- In 2025, more than 40% of professionals globally report having more than one income stream

- In Singapore, 57% of professionals plan to change jobs this year, with 58% of workers observing a rise in individuals holding multiple jobs

- U.S. freelancers are projected to reach 86.5 million by 2027—that's 50.9% of the entire workforce

- This Isn't Junior Talent Testing the Waters:

- 72.8% of fractional professionals have 15+ years of experience

- These are seasoned executives who've proven themselves in traditional roles and are now choosingflexibility

- Average monthly compensation for fractional sales leaders hit $9,651 in 2024, with hourly rates reaching $213

- The Returns Are Real:

- Portfolio careerists earn 30% more than equivalent full-time employees on average

- Portfolio careerists report 43% higher job satisfaction than traditional employees

- For many executives, a portfolio of three fractional roles generates more income than a single full-time position while offering greater autonomy

People who don't have a job are the new people with a job. Heck, in my case, I haven't had a job for 35 years and have had tremendous success. I have worked really hard throughout my career to NOT have a job!

That has influenced my thinking. Years ago, I suggested on stage that not only would most people NOT have a job, but that they would have multiple jobs all at once. Today's data bears that out. Research indicates that many of these freelancers have 3-5 concurrent jobs and income sources at any given moment.

The World Economic Forum's Future of Jobs Report 2025 projects that 39% of key skills required in the job market will change by 2030. Multi-skilling isn't a nice-to-have—it's a survival strategy. One-trick ponies are going extinct.

Business Model Optionality: How You Create Value

Your career isn't the only thing that needs a portfolio approach. If you run a business, your business model itself needs optionality architecture.

The goal is to maintain multiple ways of creating and capturing value and generating revenue, each with different risk profiles:

- Your core business model: Your proven, profitable engine. Optimize it, but don't worship it. Know that it might go extinct as soon as a disruptor comes along.

- Adjacent model: In addition to your main business model, you have another one that serves a different segment, uses a different channel, or monetizes things differently. This is your hedge against volatility - you can kick it into high gear at any moment.

- Experimental model: A fundamentally different approach that could become your next core. This is your moonshot. It's your disruptive idea.

The companies that thrive in exponential times aren't those with the single "best" business model. They're the ones with multiple viable business models ready to scale depending on which future arrives!

Product & Service Optionality: What You Offer

The same architecture applies to your product and service offerings. In a world where customer behavior changes faster than your product lifecycle, betting everything on a single product or service is suicide. I've long suggested that you focus on the idea of chameleon revenue - developing the ability to earn income from products that do not yet exist, to replace the income from products that soon won't exist!

This means having multiple product or service streams happening all at once:

- Cash cow offerings: These are your mature, profitable products, requiring maintenance but not reinvention. These provide investment funds for your experiments.

- Growth offerings: New products that are new to market. They are gaining traction, requiring investment, but proving out new value propositions.

- Experimental offerings: These are your newest risky bets. They are early-stage, high uncertainty products but positioned to capture emerging demand.

You no longer sell one thing - you sell many things at different stages of the product lifecycle.

Revenue Source Optionality: Where Income Flows From

The final dimension of Optionality Architecture is diversifying where your money comes from. This applies whether you're an individual or an organization.

For individuals, not only do you need multiple careers, but you need multiple sources of income to stay resilient and adaptable. When one stream dries up, others continue flowing. This isn't about the idea of the"side hustle" as something fun to do - it provides strategic redundancy.

That's why you see some of the most successful people on LinkedIn talk about their multiple revenue sources, which might include:

- Primary employment or client work

- Consulting or advisory retainers

- Digital products (courses, templates, content)

- Investment income or equity stakes

- Royalties, licensing, or intellectual property

- Speaking, teaching, or training

For organizations? It's all about diversification of revenue:

- Different customer segments (enterprise vs. SMB vs. consumer)

- Different geographies (domestic vs. international markets)

- Different payment models (recurring vs. transactional vs. outcome-based)

- Different value chain positions (direct vs. platform vs. infrastructure)

Take all of the above, and you get an idea that the future is all about options - and about having an architecture or structure that lets you put those options in place.

1. The Exponential Mindset

The mindset you need to get into is learning how to develop low-cost, high-upside bets across all four areas above.

Your individual capabilities—your skills, knowledge, and career path—should be treated as a financial portfolio: de-risked by diversification, and constantly positioned for a major payoff.

2. The Linear Trap

Are you trapped in a linear world, trapped by one thing, instead of having options with many things? Here's a key question you need to ask yourself: If your primary product or service became obsolete in 18 months, what would you sell instead?

If you don't have an answer, you don't have optionality—you have a single point of failure. Right now, you should do an immediate 'what-if' test:

- What if your largest customer left tomorrow?

- What if your primary revenue stream declined 50% in a year?

- What if your industry's pricing model fundamentally shifted?

If any of these scenarios were catastrophic, your revenue architecture lacks sufficient optionality!

But once you have options, you have a future!

3. The Exponential Edge

When you construct an architecture of options, you gain critical survival skills

- A pivot plan: You stop waiting for certainty and start creating it! With multiple low-cost experiments running (in skills, business models, products, and revenue sources), you gain real-time insight into what might work for you tomorrow (remember my idea of 'experiential capital')

- The ability to quickly pivot: When one idea suddenly takes off, you can kill or pull back your other experiments and redirect resources instantly, gaining weeks or months of advantage over competitors. They're still trapped in the decision-making loop - while you are moving forward, fast.

Have many options, many plans! The faster you cycle through options, the faster you learn which futures are actually arriving.

4. The Immediate Pivot

So how do you get there? You must move from a fixed roadmap to 'portfolio thinking.'. Here are your immediate actions:

- Play money: the 10/100 rule: Reallocate 10% of your available budget (time, money, or talent) away from incremental projects (the 10% gain) and dedicate it entirely to 10 distinct, small, high-risk bets (the 100x potential). If all ten fail, you only lost 10% of the budget. If one succeeds, you win the future. From a personal perspective, spend more time playing with new things. (Hello, AI!)

- The "three skills" architecture: For your own personal development, identify your current, highest-value skill (i.e., your present income stream). Then, identify two new, non-overlapping skills that might be complementary to it (the future option). Dedicate 80% of your learning velocity to the present, and 20% to building this new future skill.

- The revenue redundancy audit: Map every source of income you currently have. If more than 70% comes from a single source, you don't have optionality—you have dependency. Begin building at least one additional stream this quarter.

Bottom line?

Understand the scope of this critical change - it turns upside down a century or more of traditional thinking!

Linear leaders are prisoners of the past. They cling to the single, massive investment—the obsolete technology, the fixed office tower, the narrow skill set—because of the time, money, or ego already invested. They focus on minimizing losses on old decisions (sunk costs) rather than maximizing gains on new opportunities (optionality).

And if you think about that, it's like a "stubbornness tax." It's the compounding cost of refusing to adapt.

In an exponential world, every year you cling to a single path while the market shifts is a year of compound disadvantage.

The winners of volatility move forward, not back.

They do so by having options.

Many options.

An architecture of options.

Futurist Jim Carroll had many options throughout his career, and has many left.