"It’s difficult to take on difficult decisions - but it becomes infinitely more difficult if you do not! - Futurist Jim Carroll

Hard decisions get harder when you wait.

Particularly when uncertainty rules and volatility rages.

Have you noticed the signals coming out that in the US, people aren't thinking that the economy is as rosy as they thought? Strip away the massive AI capital spending, and you've got a dismal picture of layoffs, tariffs, a cutback in spending and investment, and a general malaise. Welcome back, Jimmy Carter!

My wife and I were talking yesterday about this in the context of what we see in the speaking business. Not a day goes by that a speaker bureau owner or agent posts about trends they see in the industry - a slowdown in bookings, client indecision, shortened lead times. Want a good example? Read this post by Dogan Altinda, "The New Urgency": How the Keynote Speaker Market Is Transforming" - it's over on LinkedIn.

One of the key findings? What was once 6-12 months is now 1-3 months, with 45% of keynote speakers booked with less than three months' notice, driven by economic caution and volatility.

I'm certainly seeing it - and one of the reasons why is because my topics often take on difficult topics: business model disruption, technological acceleration, the rapid emergence of new competitors, generational change, and more. I'm usually brought in by the CEO or senior executive of an organization to open a corporate offsite meeting or event, to set the stage for the difficult decisions that will be covered in the next day or two.

And quite simply, organizations are not taking on those difficult decisions - they are treading water, waiting and watching, waiting for some sort of major event to set the world on a more even path going forward.

And the fact is, the longer organizations wait, the tougher the future will be to navigate.

But it's certainly understandable. When times are tough economically, leaders face really difficult choices, like cutting jobs, restructuring debt, or changing their business model, or responding to the insanity of tariffs imposed willy-nilly. These decisions hurt in the short term. But avoiding that immediate pain almost always makes things exponentially worse later.

Throughout 2025, as people and organizations have faced ongoing economic volatility and uncertainty, we've seen this principle play out again and again.

Our brains are wired to avoid tough calls. Psychologically, we are structured with this type of thinking:

- Loss aversion: We feel losses about twice as strongly as gains. Losing $100 hurts way more than gaining $100 feels good. So leaders often wait for uncertain gains rather than accept certain losses—even when waiting is worse.

- Status quo bias: Sticking with the current situation requires less mental energy than evaluating change. When you're stressed by market volatility, your brain defaults to "keep things as they are" because it's easier, not because it's better.

- Narrow thinking. During crises, about 53% of leaders become more closed-minded and controlling rather than open and curious, making the problem worse throughout their organization.

What's the price of indecision? Lots!

- Missing the digital shift: When new technologies or business models emerge, the difficult decision is admitting your current approach is becoming obsolete. Companies see the threat but delay the painful pivot because it means cannibalizing existing profitable businesses or admitting past strategies were wrong.

- The waiting game backfires: Organizations often adopt a "wait and see" approach with disruptive trends, hoping clarity will emerge or the threat will fade. But waiting for certainty means competitors who move early capture market position, talent, and customer relationships that become nearly impossible to win back later.

- Strategic paralysis: When executives avoid making hard calls about which future trends to bet on—whether it's AI transformation, sustainability requirements, or changing customer preferences—they default to small, safe improvements. These incremental moves feel less risky but leave the company fundamentally unprepared when the market shifts decisively.

The most successful organizations understand that uncertainty about future trends is the new normal, not a temporary fog that will lift. Delaying transformation while waiting for perfect information means missing the window when investments are cheaper and competitive positioning is still available.

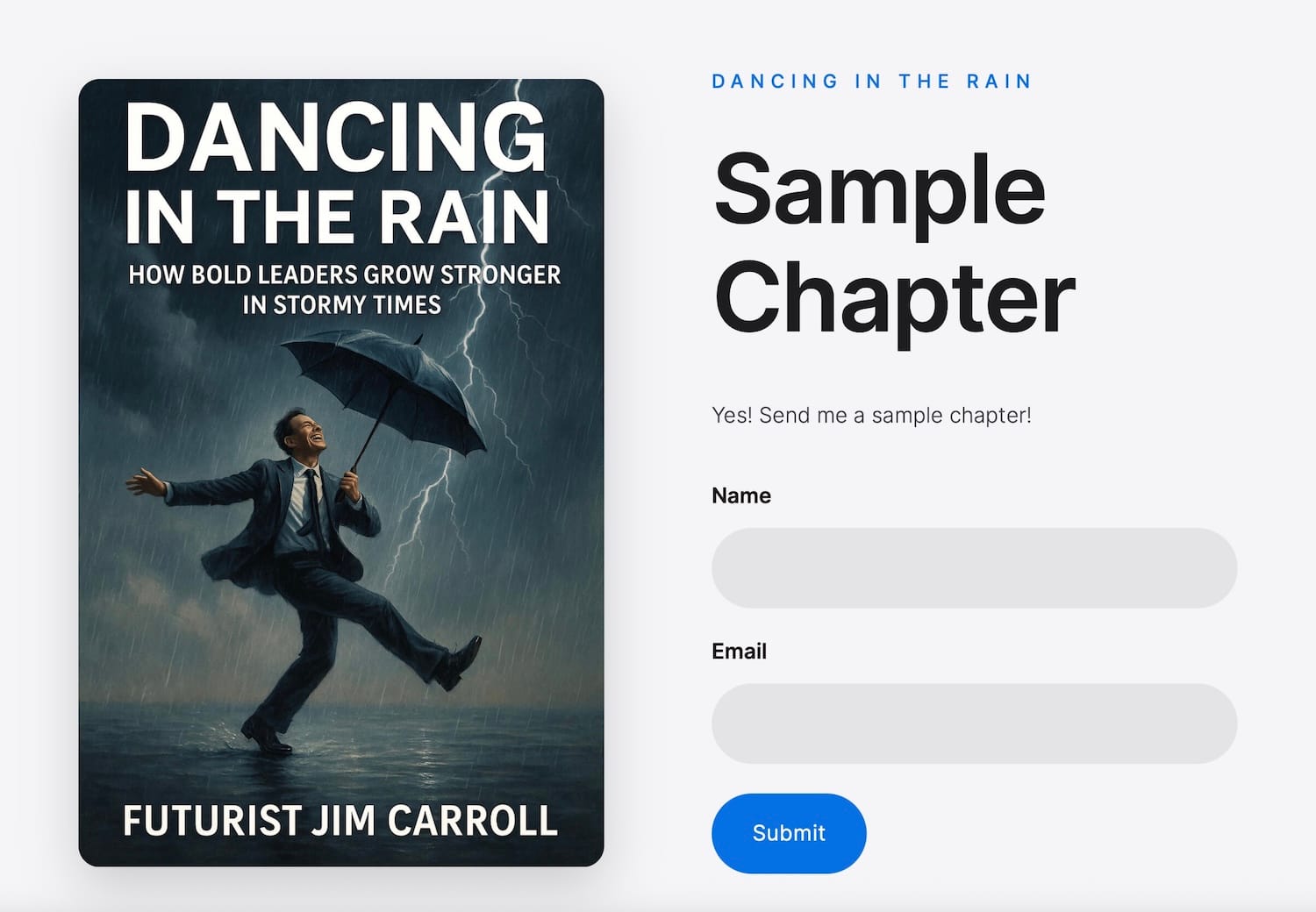

They learn to dance in the rain! That's why I wrote the book! And you can grab 2 sample chapters for free at the book website - what are you waiting for?

Look, in 2025's volatile environment, avoiding difficult decisions feels rational - you're being cautious, waiting for better information. But this has three fatal flaws:

- Competitors who act decisively capture the opportunities you're missing

- Underlying problems get worse while you wait, often accelerating once they cross critical thresholds

- The window for action narrows—options available today may be impossible later

The difficult decision represents the cost of adjustment. The more difficult situation you face later represents the cost of inaction, which often includes complete failure.

Studies show firms combining disciplined cost control with selective strategic investments roar out of recessions.

That's why momentum matters more than perfection!

Get moving!

Futurist Jim Carroll believes that indecision is the cardinal sin of failed leadership.