"The greatest threat to a disruptor isn't a fortified incumbent. It's an incumbent that remembers how to disrupt." - Futurist Jim Carroll

My post on 'competitive intelligence' yesterday drew a few comments from folks - what do you do if your industry is moving so fast that the competition seems to have an insurmountable advantage? What if they seem to own the disruption game?

Disrupt them instead.

With that idea in mind, turn that weakness into a strength. I decided that for this particular situation, I wanted to build a section into the outline that would cover "hidden lessons from business disruption battles," going beyond the typical Silicon Valley business model disruption stories that get into this type of idea. The fact is, some of the most compelling business-disruption stories often unfold far from Silicon Valley's spotlight - and provide some very valuable lessons.

I jumped into the Deep Research mode of Gemini with that question, and then. used Gamma to develop this set of slides. You can grab the associated PDF here.

These are some great stories, involving:

- Danish shipping giants are studying containerization to transform global trade.

- Turkish grocery startups are conquering Europe with local market insights.

- Century-old retailers beating Amazon at its own e-commerce game.

From Southeast Asian super-apps defeating Uber to Walmart outmaneuvering Amazon in e-commerce growth, these stories demonstrate that successful adaptation depends less on resources or technology than being innovative with a counter-disruptive idea.

Let's start by taking a look at Walmart's e-Commerce resurrection.

By 2018, analysts predicted Amazon's dominance would devastate traditional retail. Instead, Walmart achieved 40% e-commerce growth, outpacing Amazon by reimagining its 4,700 physical stores as fulfillment centers rather than liabilities. Walmart's stores reach 90% of Americans within one day, eliminating shipping costs and delivery delays. The "Buy Online, Pick Up in Store" model they put in place turned massive real estate into a logistics advantage that pure digital players cannot match.

- E-commerce Growth: 40% was Walmart's annual growth rate.

- Store Network: 4,700 physical locations were used as assets.

- American Coverage: 90% of the population was within one day's reach.

So much for giving into the idea that retail is all about all-Amazon all-the-time.

Or how about Target's digital transformation success? They invested $7 billion in digital transformation starting in 2017. Their team studied startups like Shipt and Instacart, acquiring Shipt for $550 million to gain same-day delivery capabilities.

Target's breakthrough came from converting over 1,000 stores to ship orders directly, which reduced delivery costs by 90% compared to traditional warehouses. By Black Friday 2019, Target's app became the #1 shopping app in America, beating Amazon for the first time. Their weakness? Being disrupted by Amazon. Their strength? 1,000 stores that became logistics spikes! (Yes, since then, Target has seen a significant downturn, but not related to this strategic pillar.)

Then there is the Scandinavian shipping revolution. Long before tech disruption became mainstream, A.P. Moller-Maersk's containerization gamble demonstrated how visionary leaders study emerging threats and place transformational bets.

- 1973: The Big Bet: CEO Mærsk Mc-Kinney Møller committed to containerization when most shipping lines hesitated.

- Systems Thinking: The company built three integrated networks: physical ships, digital systems, and direct country offices.

- Global Leadership: Within 25 years, Maersk achieved global leadership in container shipping with sustainable advantages.

Rather than just buying container ships, Maersk built a comprehensive infrastructure that went further. This different style of thinking separated Maersk from competitors who approached containerization piecemeal, creating competitive advantages that persist today.

Perhaps no story better illustrates how local knowledge trumps global resources than Grab and Gojek's systematic defeat of Uber across Southeast Asia. Despite Uber's aggressive expansion and proven business model, both local companies forced the American giant to sell its operations to Grab in 2018. The winning strategy centered on deep cultural understanding rather than technical superiority.

- Cash Payments: Grab and Gojek accepted cash when most users were unbanked, while Uber insisted on cashless transactions.

- Motorcycle Taxis: They started with "ojeks" (motorcycle taxis) in traffic-congested cities, something Uber couldn't replicate.

- Super-App Ecosystem: The services evolved into payments, food delivery, and financial services.

- Local Understanding: The companies hired local staff and understood informal transportation systems.

Last but not least, take a look at fashion's speed wars - and the whole idea of when fast isn't fast enough!

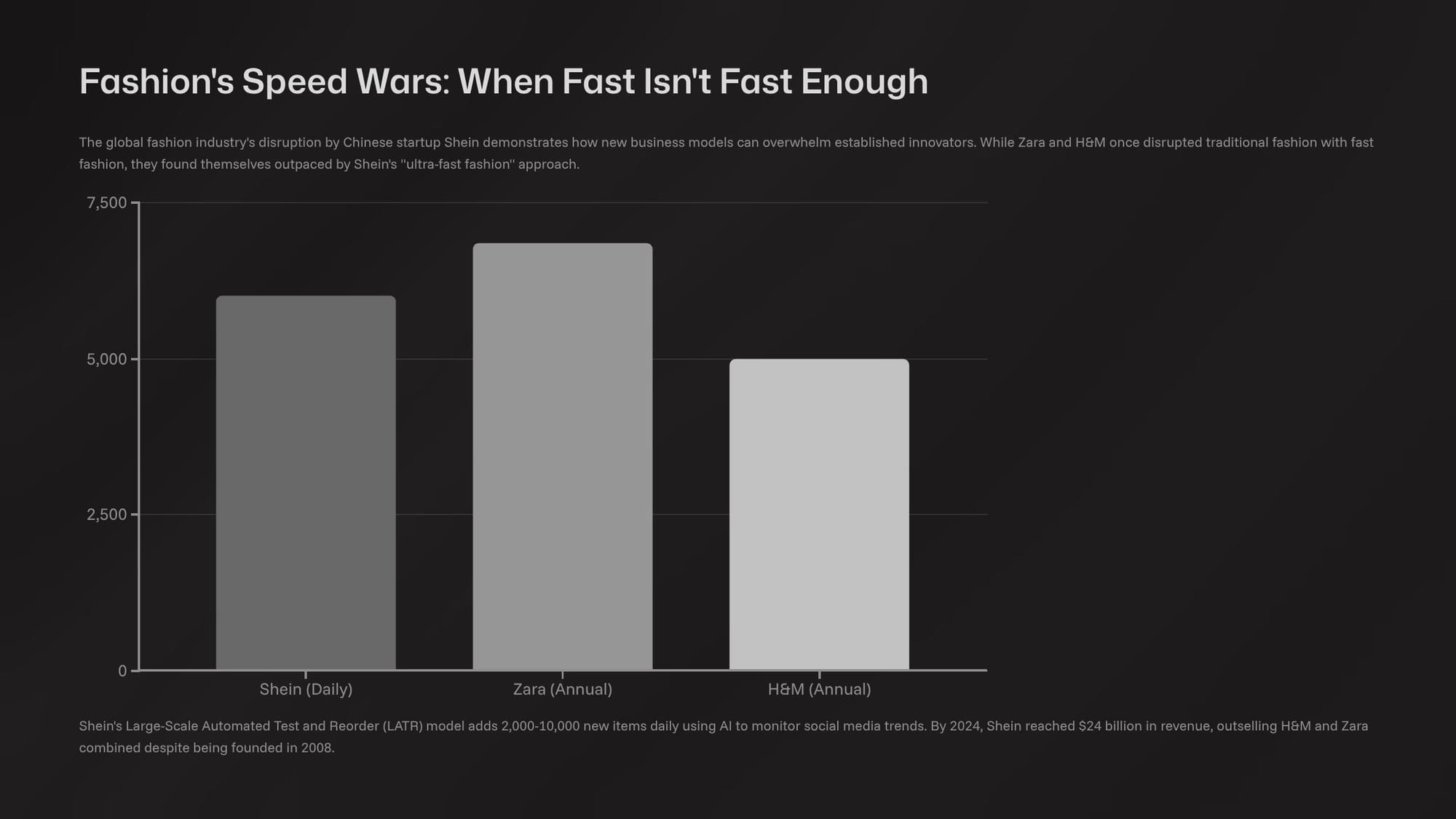

The global fashion industry's disruption by Chinese startup Shein demonstrates how new business models can overwhelm established innovators. While Zara and H&M once disrupted traditional fashion with their "fast fashion"model, they found themselves outpaced by Shein's "ultra-fast fashion" approach. Do you see an influencer on social media with an outfit you like? Shein probably saw it too and had it ready for sale within hours.

Their Large-Scale Automated Test and Reorder (LATR) model adds 2,000-10,000 new items daily by using AI to monitor social media trends. By 2024, Shein reached $24 billion in revenue, outselling H&M and Zara combined despite being founded in 2008. (Yes, this model has pretty much been obliterated through the tariff wars and elimination of de minimis shipping, but who could have seen that coming?)

These stories reveal that successful adaptation to competitive threats follows patterns that contradict popular business theory. Disrupt the disruptors! Technology, resources, and first-mover advantages matter far less than deeply understanding customer needs and leveraging unique organizational assets.

- Transform assets: Physical assets become competitive advantages when reimagined creatively. View existing assets as platforms for new capabilities rather than constraints.

- Local knowledge wins: Cultural and local knowledge often trump global resources and technical superiority. Success requires understanding why customers respond to challenger approaches.

- Study customer evolution: The most profound lesson is that studying challengers means studying customer evolution. Winners recognize how expectations are changing and develop unique responses.

In an era of constant competitive pressure, the question isn't whether to study challengers and emulate them, but disrupt them with an entirely different form of thinking!

Futurist Jim Carroll has been studying the key concepts of innovative thinking for over 25 years. This is but one of many stories he shares from the stage.