"The future isn't online or in-store; it's a personalized, phygital experience where every interaction builds a lasting connection." - Futurist Jim Carroll

(Futurist Jim Carroll is writing a series on 30 Megatrends, which he first outlined in his book Dancing in the Rain: How Bold Leaders Grow Stronger in Stormy Times. The trends were shared in the book as a way of demonstrating that, despite any period of economic volatility, there is always long-term opportunity to be found. The book is now in print - learn more at dancing.jimcarroll.com)

Retail and commercial spaces are being fundamentally reimagined, not eliminated. They are being transformed into experience centres rather than transactional environments. The role of physical space in customer journeys is being completely redefined.

It's called The Experience Economy, and involves the introduction to your vocabulary of an entirely new word: phygital. Here's the full PDF report.

What's it all about? Think about how much retail has changed in the last few years with e-commerce and online shopping. Mix in the accelerator that was the pandemic. Add to it faster-moving technology. Bring in the fact that many retail stores are in decline in terms of traffic, design, and layout as people shop in person less. The idea? Change it all up to bring the opportunity of that in-store experience back, but with a twist: stores and retail not just as a place to shop, but as a place to experience.

The result is a global retail landscape undergoing an irreversible paradigm shift from a purely transactional model towards one centered on experience. This transformation is driven by the strategic integration of physical and digital worlds—"phygital" retail. Physical retail spaces are being reimagined as dynamic experience centers, where the primary objective is to forge deep, emotional connections with consumers.

- $25B Phygital Market 2023 - Current market valuation

- $52.5B Projected by 2030 - With 11.2% CAGR

- 65% Consumer Preference - Shoppers prefer phygital experiences

Put this in context: The narrative of a "retail apocalypse" has proven to be a misinterpretation of a far more nuanced transformation. The decline of traditional retail does not signify the death of the physical store; rather, it marks its rebirth with a fundamentally new purpose. Unable to compete with the boundless inventory and convenience of online platforms, physical retail's new mandate is to offer what the digital world cannot: tangible, multi-sensory, and emotionally resonant experiences.

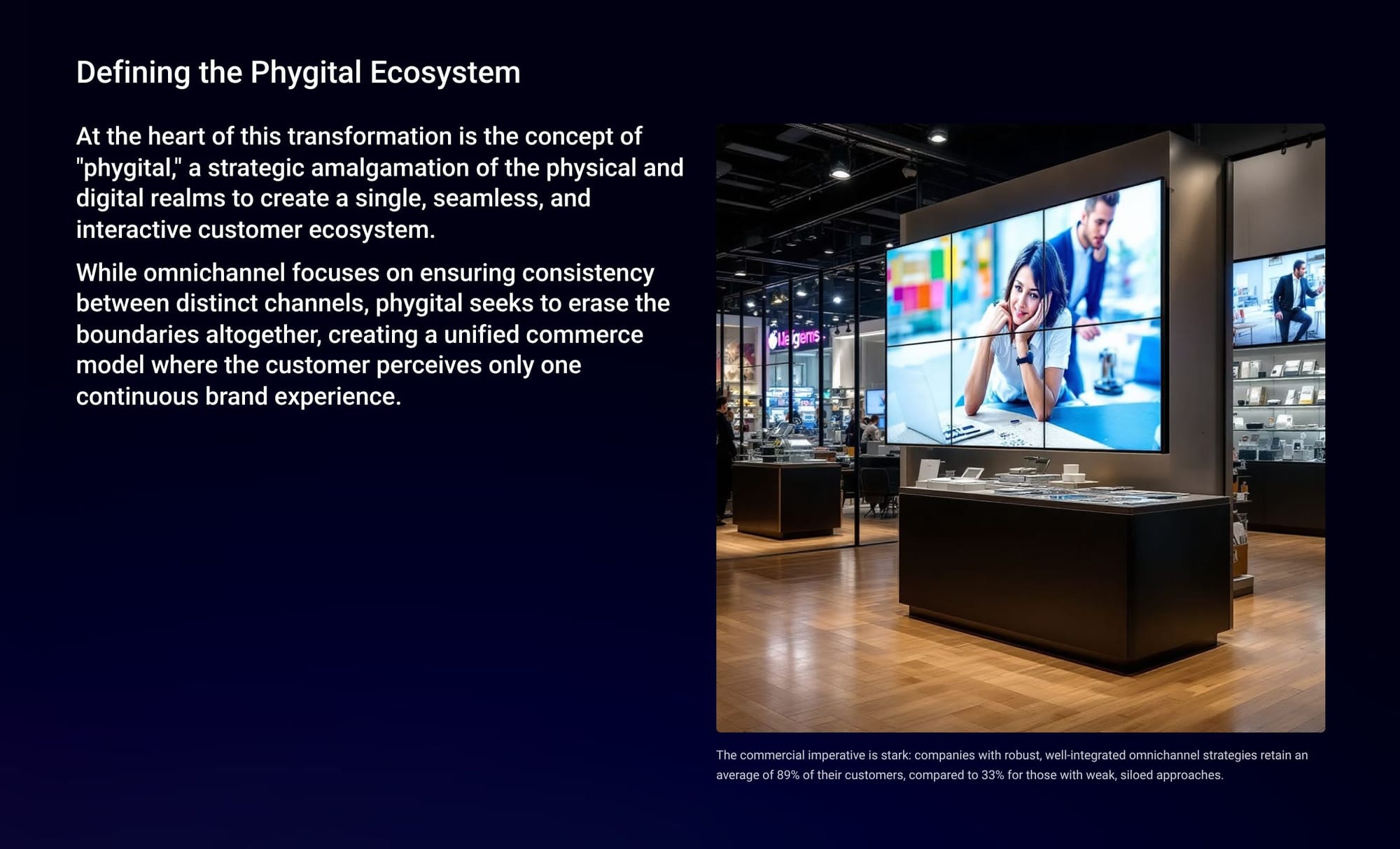

At the heart of this transformation is the concept of "phygital," a strategic amalgamation of the physical and digital realms to create a single, seamless, and interactive customer ecosystem.

While omnichannel (the idea of making sure the online and physical store work in harmony - i.e, think of picking up the groceries you ordered online at a store) focuses on ensuring consistency between distinct channels, phygital seeks to erase the boundaries altogether, creating a unified commerce model where the customer perceives only one continuous brand experience. The commercial imperative is stark: companies with robust, well-integrated omnichannel strategies retain an average of 89% of their customers, compared to 33% for those with weak, siloed approaches.

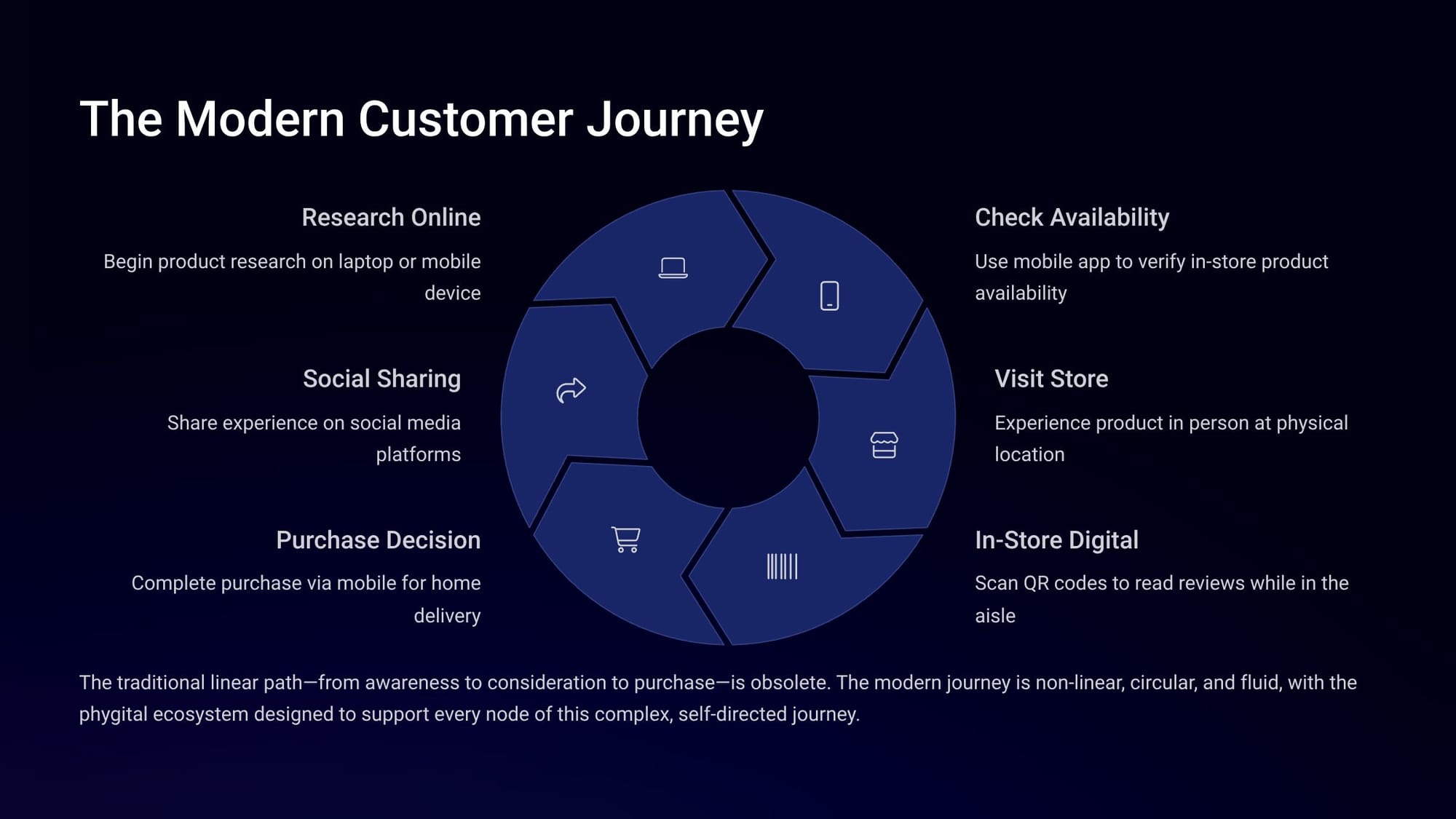

Think about how much the modern customer of today has already changed. The traditional shopping path from awareness to consideration to purchase is obsolete. The modern journey is entirely different, with the phygital ecosystem designed to support every node of this complex, self-directed journey. Here's what people do when shopping now:

- Research Online: Begin product research on a laptop or mobile device.

- Check Availability: Use the mobile app to verify in-store product availability.

- Visit Store: Experience the product in person at a physical location.

- In-Store Digital: Scan QR codes to read reviews while in the aisle.

- Purchase Decision: Complete purchase via mobile for home delivery.

- Social Sharing: Share experience on social media platforms.

That's a lot of steps for a potential opportunity!

The idea of "phygital engagement" takes on this opportunity through three key ideas:

1. Immediacy. Addresses the consumer’s desire for instant gratification through technologies that remove friction and accelerate fulfillment:

- "Just walk out" technology ,pioneered by Amazon Go

- Real-time inventory systems

- Rapid fulfillment options like BOPIS

2. Immersion. Makes the consumer an active participant in the brand's world through:

- Meticulously designed physical environments

- AR/VR for product visualization

- Engaging brand narratives that transcend shopping

3. Interaction. Enables novel, hands-on engagement with products and brands:

- Interactive kiosks with endless-aisle capabilities

- Smart mirrors offering personalized styling advice

- Gamified mobile apps turning store visits into experiences

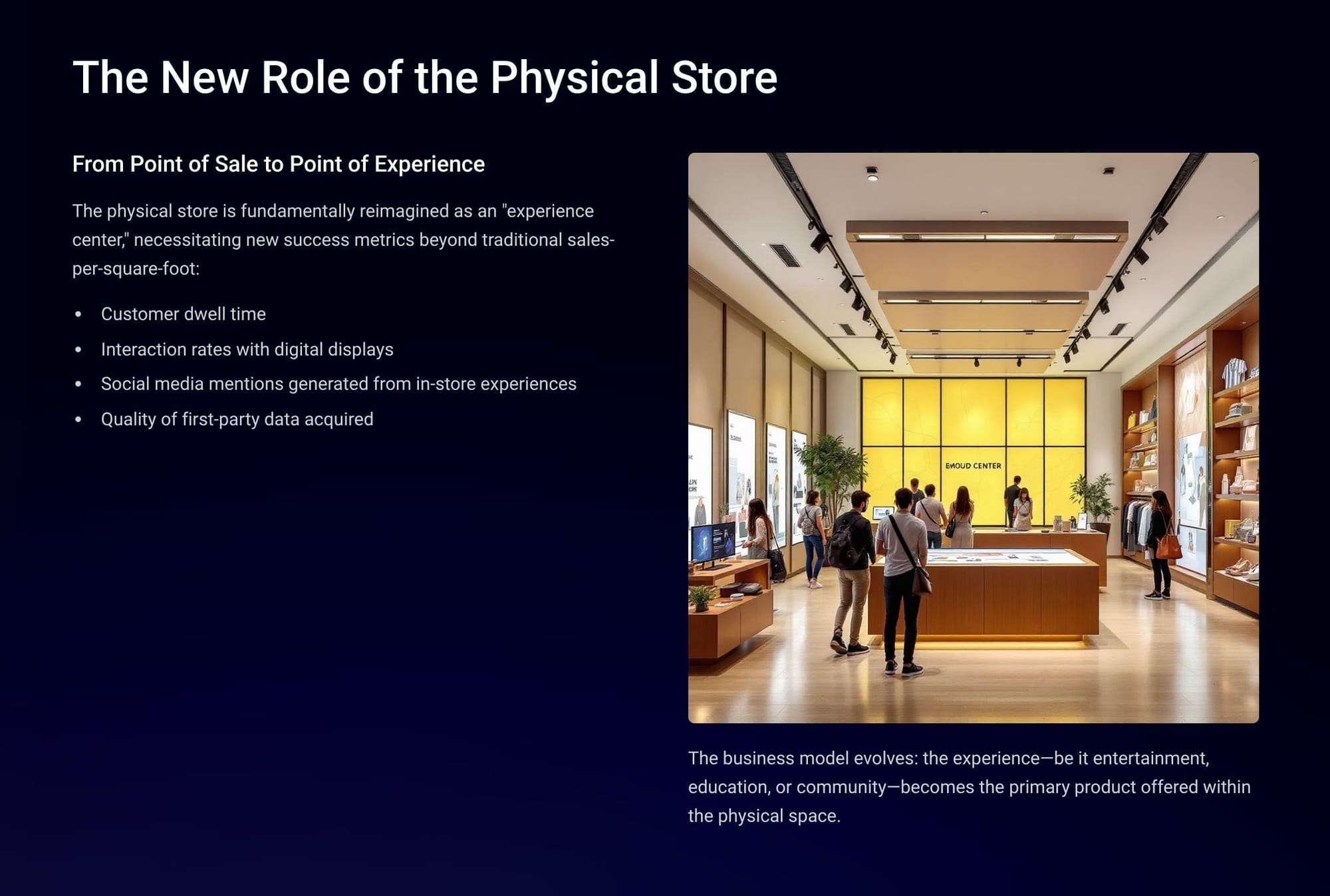

In doing so, the new role of the physical stores evolves from the idea of "point-of-sale" to "point of experience." The physical store is fundamentally reimagined as an "experience center," necessitating new success metrics beyond traditional sales-per-square-foot:

- Customer dwell time

- Interaction rates with digital displays

- Social media mentions generated from in-store experiences

- Quality of first-party data acquired

The business model evolves: the experience—be it entertainment, education, or community—becomes the primary product offered within the physical space.

What's the technology behind all this? It's a sophisticated and deeply interconnected ecosystem of technologies. These tools are not standalone solutions but components of an integrated "stack", where data flows seamlessly between layers. It's not one single piece of technology, but an entirely new retail infrastructure.

First, there is the role of immersive visualization: augmented reality and virtual reality. This allows for:

- Overlays digital information onto the real world through smartphones or smart mirrors:

- Virtual try-on for apparel and cosmetics (Sephora, Gucci)

- In-home visualization for furniture (IKEA, Wayfair)

- In-store navigation and interactive product information

The impact? Experience has already shown that products with AR content experience 94% higher conversion rates and up to 40% reduction in returns.

Second is - surprise, surprise! - the 'intelligent core' of AI and Data Analytics:

- AI-Powered Personalization Engines. Analyze customer data across touchpoints to deliver hyper-personalized recommendations, promotions, and content.

- Smart Mirrors. Interactive terminals with cameras, touchscreens, and AI that facilitate virtual try-ons, suggest complementary items, and allow seamless requests for assistance. Global smart mirror market projected to reach $5.58B within four years.

- Dynamic Layout Optimization. AI analyzes data from cameras and sensors to generate heat maps of customer flow, identify bottlenecks, and optimize store layouts. IKEA redesigned showrooms based on these analytics, resulting in 25% increased sales in high-traffic areas.

Third is the 'connected environment" of tech, specifically IoT, RFID, and smart beacons

- Internet of Things (IoT): A Network of physical devices embedded with sensors that exchange data, including "smart shelves" that monitor inventory in real-time and display dynamic pricing or promotions.

- Radio-Frequency Identification (RFID): Provides item-level inventory accuracy for unified commerce, enabling reliable BOPIS and ship-from-store services, frictionless checkout, and interactive displays.

- Bluetooth Beacons: Small transmitters throughout stores that enable precise location services, in-store navigation, contextual marketing, and detailed tracking of customer paths.

The power lies in interdependence: beacons provide location data, IoT sensors capture product interactions, and AI analyzes this real-time data to trigger personalized experiences.

Put it all together, and it's not your granddaddy's market anymore! The investment money is pouring into this new world:

- $131.6 billion: Global IT Investment - Projected retail spending on IT and digital technologies in 2024.

- 11%: Year-over-Year Growth - Increase in technology spending, largely for AI and automation.

- 41%: Retail Fintech - Share of total fintech VC funding in 2024, up from 23% in 2023.

Today, large, incumbent retailers are leveraging their scale to make massive investments in technology, widening their lead over smaller competitors and accelerating market consolidation. Short term? For 2025, retail executives' primary investment priorities are AI-powered demand forecasting, warehouse automation, and real-time inventory visibility technologies.

What's the future? Fast!

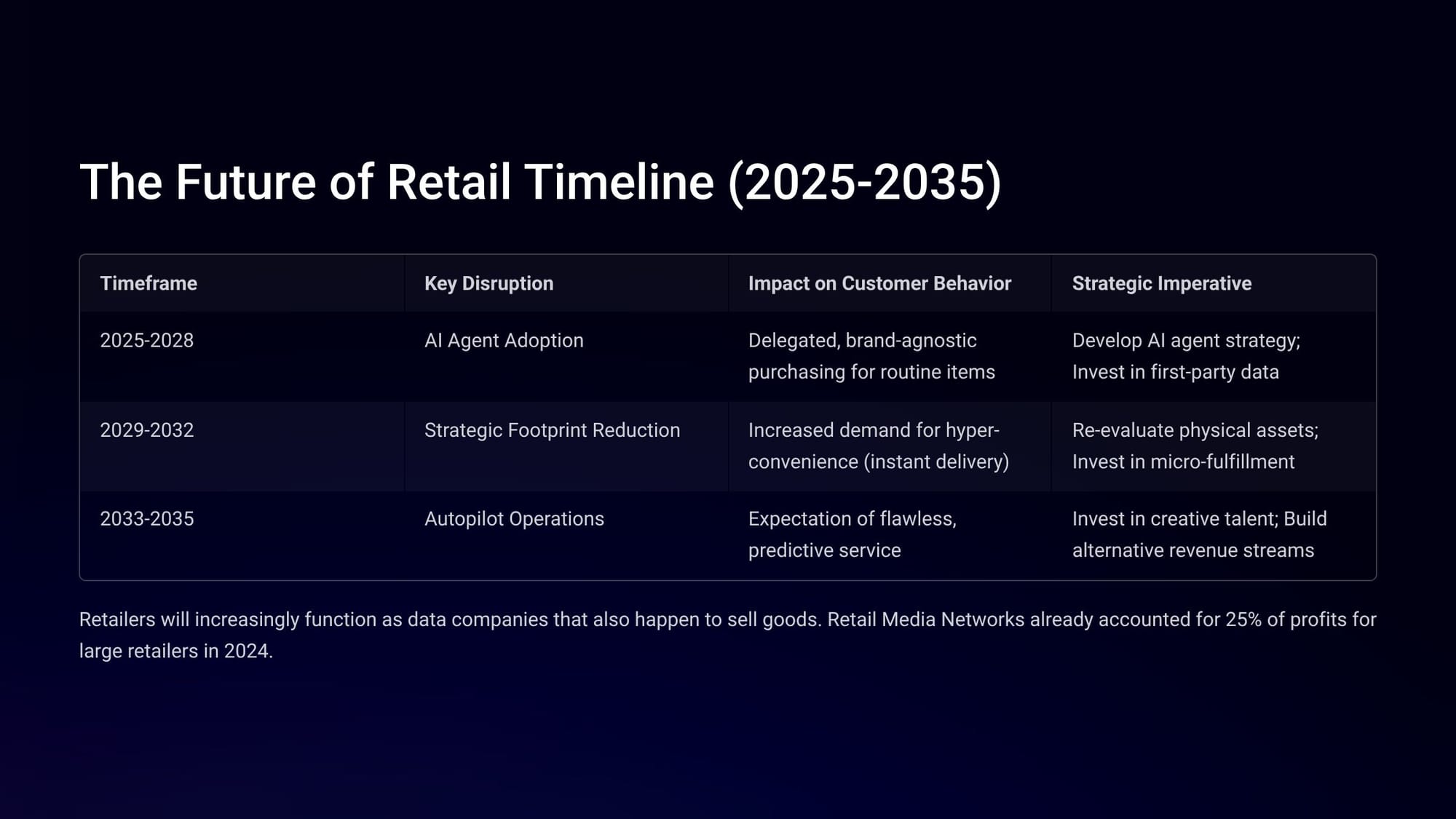

Timeframe: 2025-2028

- Key Disruption: AI Agent Adoption

- Impact on Customer Behavior: Delegated, brand-agnostic purchasing for routine items

- Strategic Imperative: Develop AI agent strategy; Invest in first-party data

Timeframe: 2029-2032

- Key Disruption: Strategic Footprint Reduction

- Impact on Customer Behavior: Increased demand for hyper-convenience (instant delivery)

- Strategic Imperative: Re-evaluate physical assets; Invest in micro-fulfillment

Timeframe: 2033-2035

- Key Disruption: Autopilot Operations

- Impact on Customer Behavior: Expectation of flawless, predictive service

- Strategic Imperative: Invest in creative talent; Build alternative revenue streams

Bottom line?

Retailers will increasingly function as data companies that also happen to sell goods, because it's all about phygital.

Futurist Jim Carroll remembers that most people dismissed the idea of online shopping when he first began to predict its dominance back in 1996.