"When capital flows as freely as ideas, the boundaries of innovation dissolve, unleashing a new era of discovery!" - Futurist Jim Carroll

(Futurist Jim Carroll is writing a series on 30 Megatrends, which he first outlined in his book Dancing in the Rain: How Bold Leaders Grow Stronger in Stormy Times. The trends were shared in the book as a way of demonstrating that, despite any period of economic volatility, there is always long-term opportunity to be found. The book is now in print - learn more at dancing.jimcarroll.com)

Corporate research labs and government agencies used to be the core of most global R&D. Think Velcro and NASA. DuPont and Kevlar. Xerox PARC and the graphical user interface. Bell Labs and the transistor. DARPA and the internet. GE and the jet engine. These institutions were once the engines of breakthrough innovation, but that's no longer the case.

Yet one of the most significant and yet most underappreciated trends of our time has to do with the fact that the very nature of scientific discovery has shifted. I'll explore this in two posts - this one, which examines the new world of new R&D models, and the next one, which outlines what comes next as the US abandons its traditional role as a leader in the technology and ideas of tomorrow. Taken together, these two trends provide for a very significant change in the very nature of 'where ideas come from.'

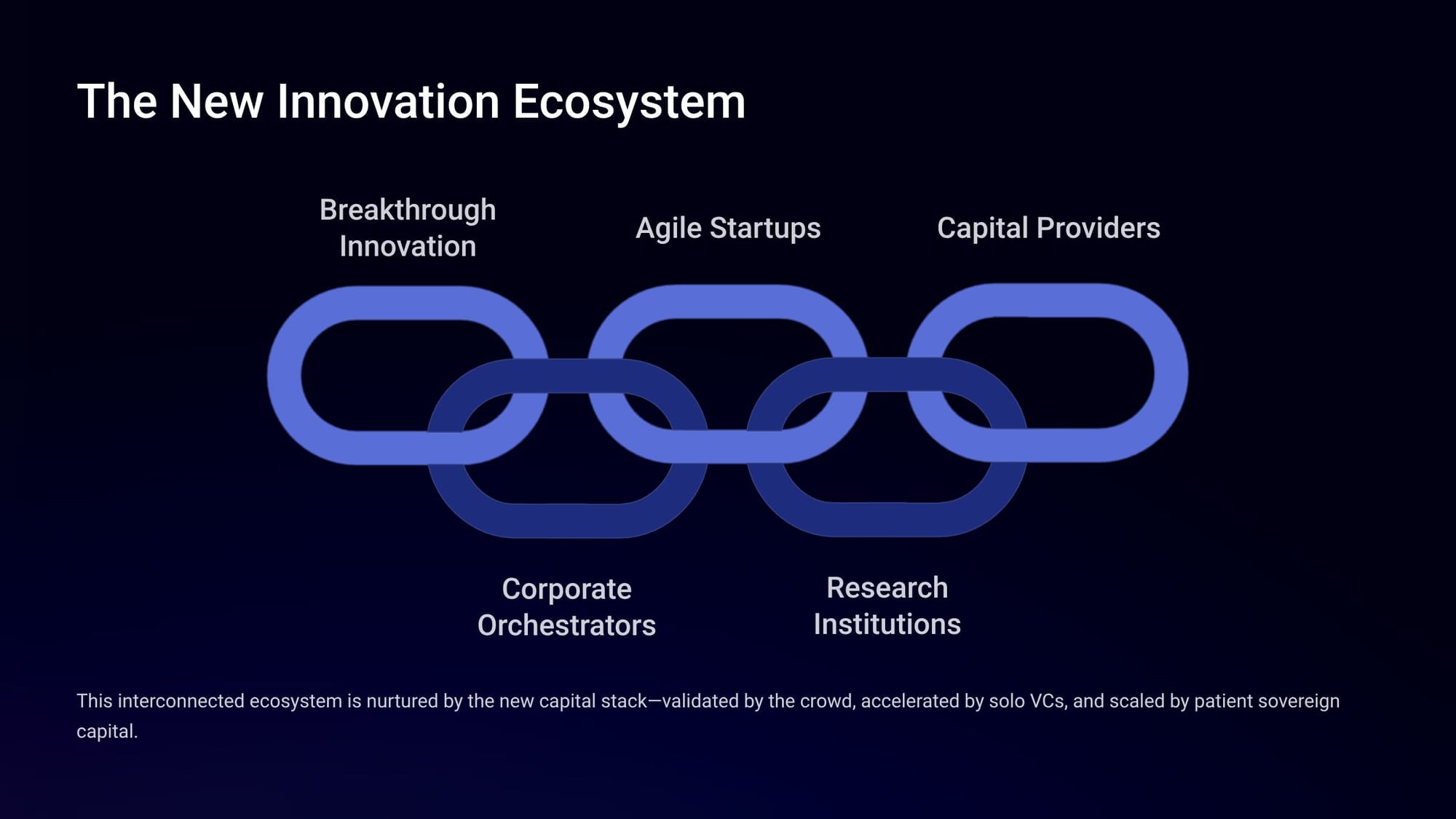

Let's start with the first trend - we are now in the midst of a historic shift in innovation finance, as capital moves from traditional corporate labs and venture capital firms to a diverse global ecosystem of crowdfunding platforms, sovereign wealth funds, and decentralized funding models. This fundamental change is democratizing access to funding and creating a more diverse innovation landscape, altering who gets to innovate, what gets funded, and where future economic power will reside.

Let's call it The Great R&D Capital Reallocation. Here's your PDF with more details on what I share below.

Where do we start? Let's go with my long-covered idea that involves 'building the unimaginable future':

"Companies that do not yet exist will build products not yet conceived using materials not yet invented with methodologies not yet in existence based on ideas not yet imagined."

This transformation is the primary enabling force that will allow for a future beyond our current imagination.

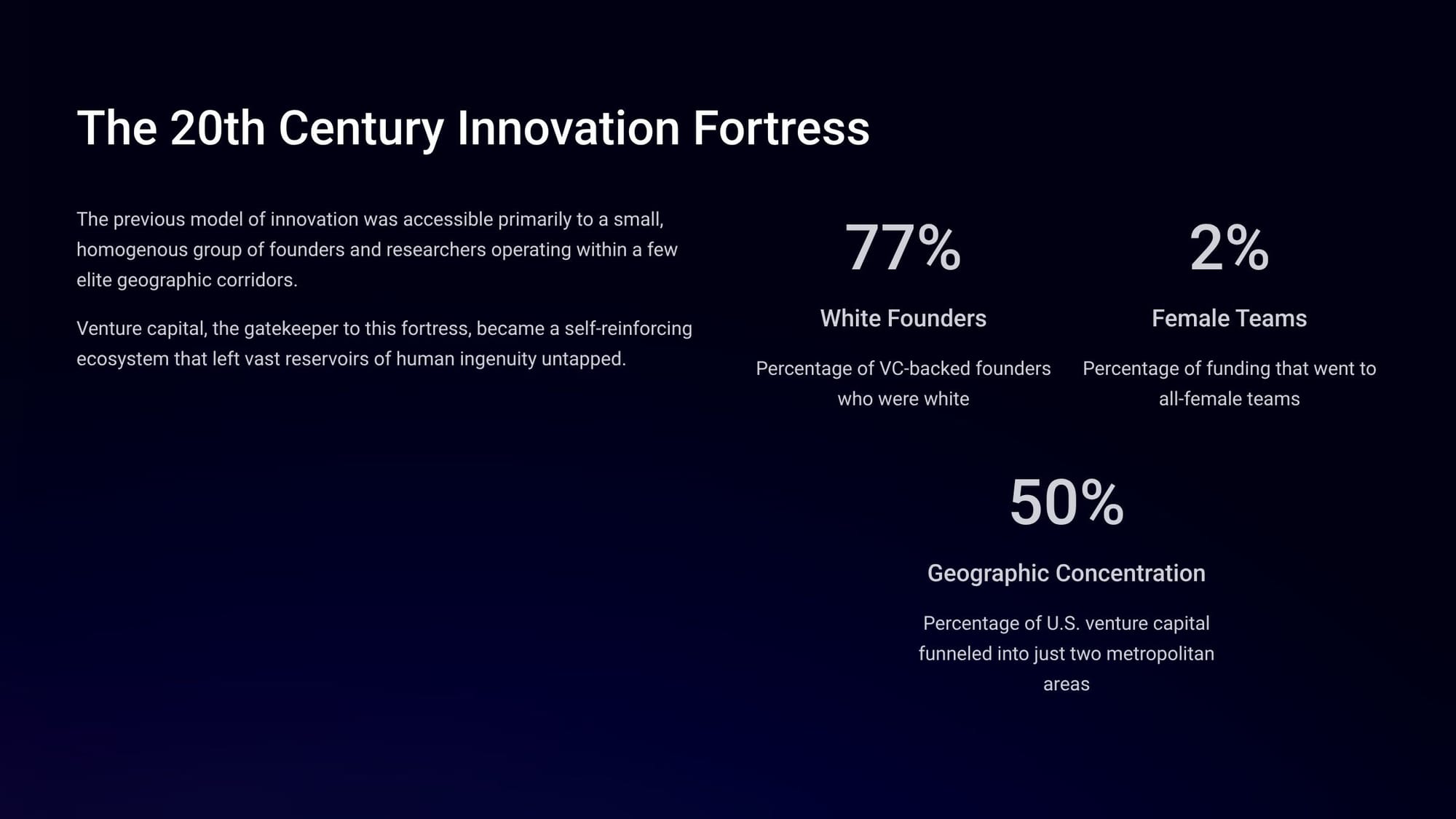

Consider how things have changed by first thinking about the 'old' world of innovation. The pursuit of innovative ideas and discoveries was accessible primarily to a small group of founders and researchers operating within a few elite geographic corridors - Boston and San Francisco. Venture capital, the gatekeeper to this fortress, became a self-reinforcing ecosystem that left vast reservoirs of human ingenuity untapped. It wasn't a very diverse group!

- 77% White Founders: Percentage of VC-backed founders who were white.

- 2% Female Teams: Percentage of funding that went to all-female teams.

- 50% Geographic Concentration: Percentage of U.S. venture capital funneled into just two metropolitan areas.

The new 21st-century model breaks down these geographic and demographic barriers:

- Global Access: Crowdfunding provides a direct pathway for entrepreneurs to bypass traditional gatekeepers, connecting creators with a global pool of backers.

- Market Validation: The funding process itself becomes a tool for market validation and community building through platforms like Kickstarter and Indiegogo.

- Inclusive Funding: Equity crowdfunding platforms report 44% of funds go to female founders and 33% of startups have BIPOC founders—a stark contrast to the traditional VC landscape.

Why is this important? It's the power of diverse perspectives! When new people from new places with new perspectives are empowered to build, they will inevitably identify and solve problems that the old guard never even saw.

What's also changed are the limitations of the old funding models.

The capital sources of the old paradigm—corporations and traditional VCs—were bound by short-term pressures and a 10-year fund cycle - you had to keep the stock market happy! This created a pretty systemic bias toward very specific types of research and often, small incremental improvements. This model was ill-suited for tackling foundational scientific challenges - think climate science - or long-horizon "deep tech" ventures, creating a critical funding gap for the very R&D that produces true breakthroughs.

The new funding ecosystem is explicitly rewiring R&D priorities to fill the gap left by traditional models, focusing on three key areas:

- Curiosity-Driven Science: Revitalizing basic research through decentralized models.

- Deep Tech: Unlocking transformative technologies with "patient capital".

- Global Challenges: Addressing humanity's most pressing problems at scale.

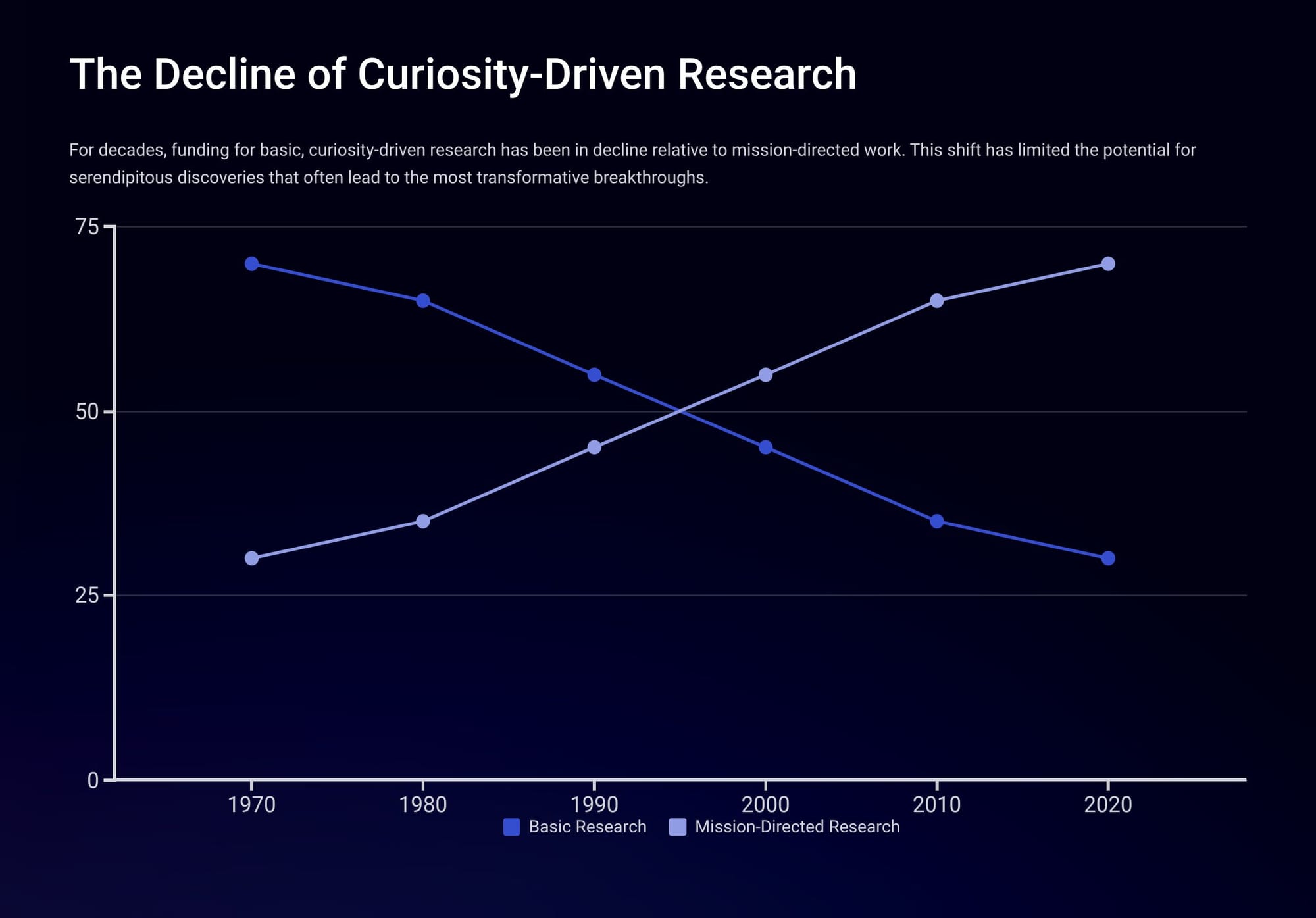

Consider the decline of what we might call "curiosity-driven research." For decades, funding for basic, curiosity-driven research has been in decline relative to mission-directed work. This shift has limited the potential for serendipitous discoveries that often lead to the most transformative breakthroughs. It's shifting from "how does thing work" to "let's make this thing work!" That's a seemingly small but massively significant change!

Then there is the rise of 'patient-capital' - basically, investment money that doesn't have to meet the needs of the short-term stock market! Sovereign Wealth Funds (SWFs), with their multi-trillion-dollar asset pools and long-term horizons, provide the 'patient capital' needed for deep tech development. And it's a big pool of money.

- $9T Total SWF Assets: Combined assets under management by global sovereign wealth funds.

- 20+ Years Investment Horizon: The Typical time horizon for sovereign wealth fund investments.

- $620B Deep Tech Investment: Estimated SWF investment in deep tech sectors by 2025.

What's the impact? SWFs like Saudi Arabia's PIF and Abu Dhabi's Mubadala are aggressively investing in high-risk, high-reward deep tech sectors that align with both financial and strategic objectives - things like AI, quantum computing, and other leading-edge trends.

What's also at work is a new world of R&D aimed at addressing the global "Grand Challenges," investing to address some of humanity’s most significant megatrends and challenges.

- Climate Crisis: Massive investment in clean energy and sustainable materials, with SWFs and crowdfunding platforms backing green tech.

- Healthcare Revolution: Convergence of AI and biotechnology attracting enormous capital flows aimed at revolutionizing healthcare through personalized medicine and AI-driven drug discovery.

- Food Security: Investment in agricultural technology and alternative proteins to ensure sustainable food production for a growing global population.

This is a very significant shift because it changes the nature of R&D from quarterly profits to innovations that can have a true generational impact. This represents a shift from funding what is merely profitable in the next quarter to funding what is essential for the next generation.

What all of this leads to is the end of the closed corporate R&D Lab. The dominant new model is "Open Innovation," where discovery happens within a distributed, collaborative ecosystem of startups, universities, and corporate partners. In this new world, large corporations are shifting from being sole creators to becoming orchestrators of innovation, leveraging the agility and creativity of a global network of smaller players.

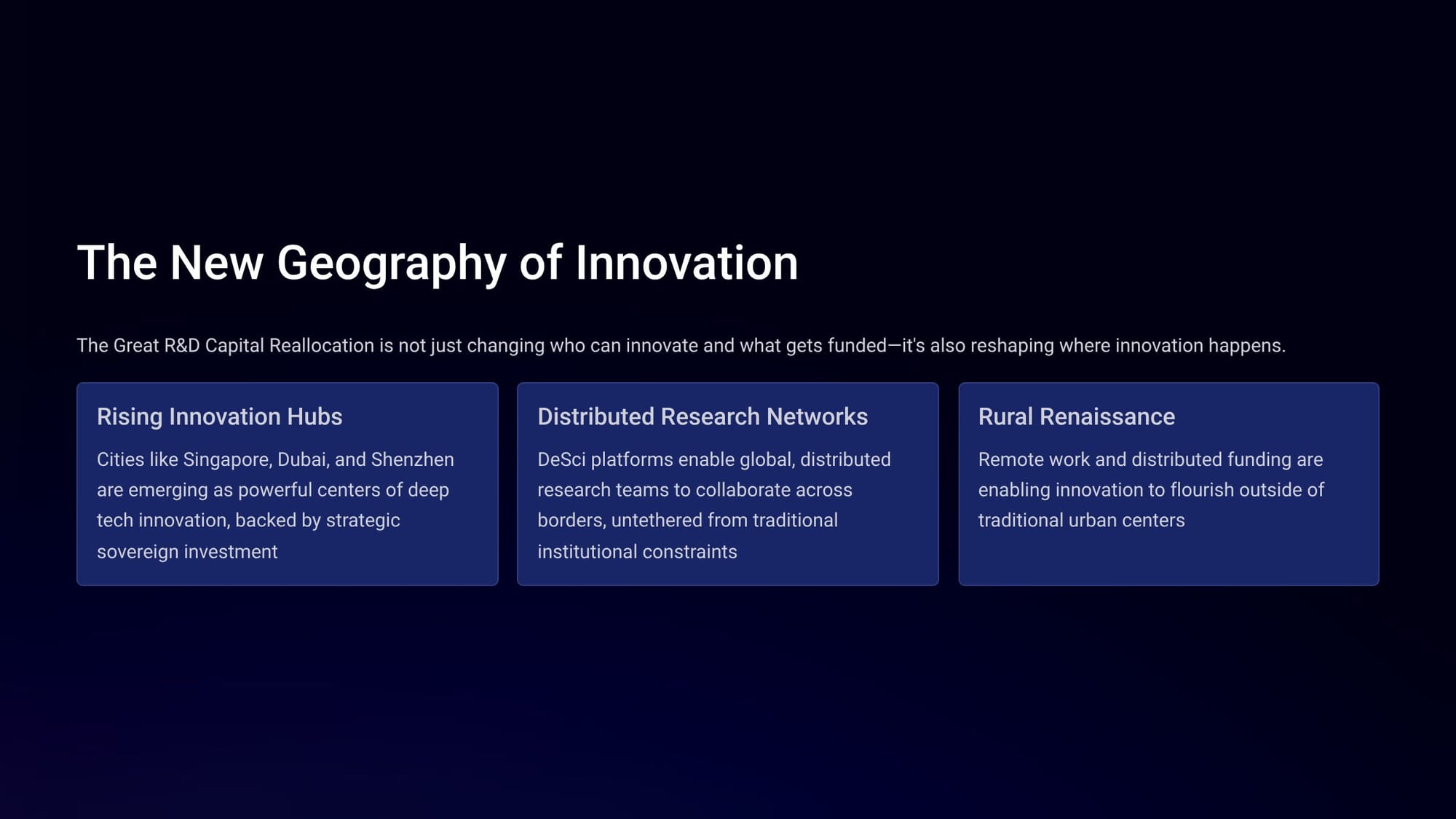

The impact of all this is that the Great R&D Capital Reallocation is not just changing who can innovate and what gets funded—it’s also reshaping where innovation happens.

- Rising Innovation Hubs: Cities like Singapore, Dubai, and Shenzhen are emerging as powerful centers of deep tech innovation, backed by strategic sovereign investment.

- Distributed Research Networks: DeSci platforms enable global, distributed research teams to collaborate across borders, untethered from traditional institutional constraints.

- Rural Renaissance: Remote work and distributed funding are enabling innovation to flourish outside of traditional urban centers.

All of this is happening in different ways in different locations around the world. At the heart of it all is this: nations are increasingly viewing technological leadership as essential to economic and geopolitical power, driving a new era of state-backed innovation investment.

- Centralized, Digital: China's state-led AI and digital infrastructure

- Distributed, Digital: US venture-backed software ecosystem

- Centralized, Physical: UAE, Saudi sovereign-funded deep tech

- Distributed, Physical: EU collaborative green tech and materials

And it involves a lot of new skills for this innovation economy:

- Cross-Disciplinary Fluency: The ability to work across traditional boundaries between fields like biology, computer science, and materials engineering.

- Distributed Collaboration: Skills for effective research and development in global, remote teams across different institutions and funding sources.

- Capital Navigation: Understanding how to access and leverage the diverse new funding mechanisms from crowdfunding to sovereign investment.

- Open Science Practices: Expertise in sharing research, data, and tools in ways that accelerate collective progress while protecting intellectual property.

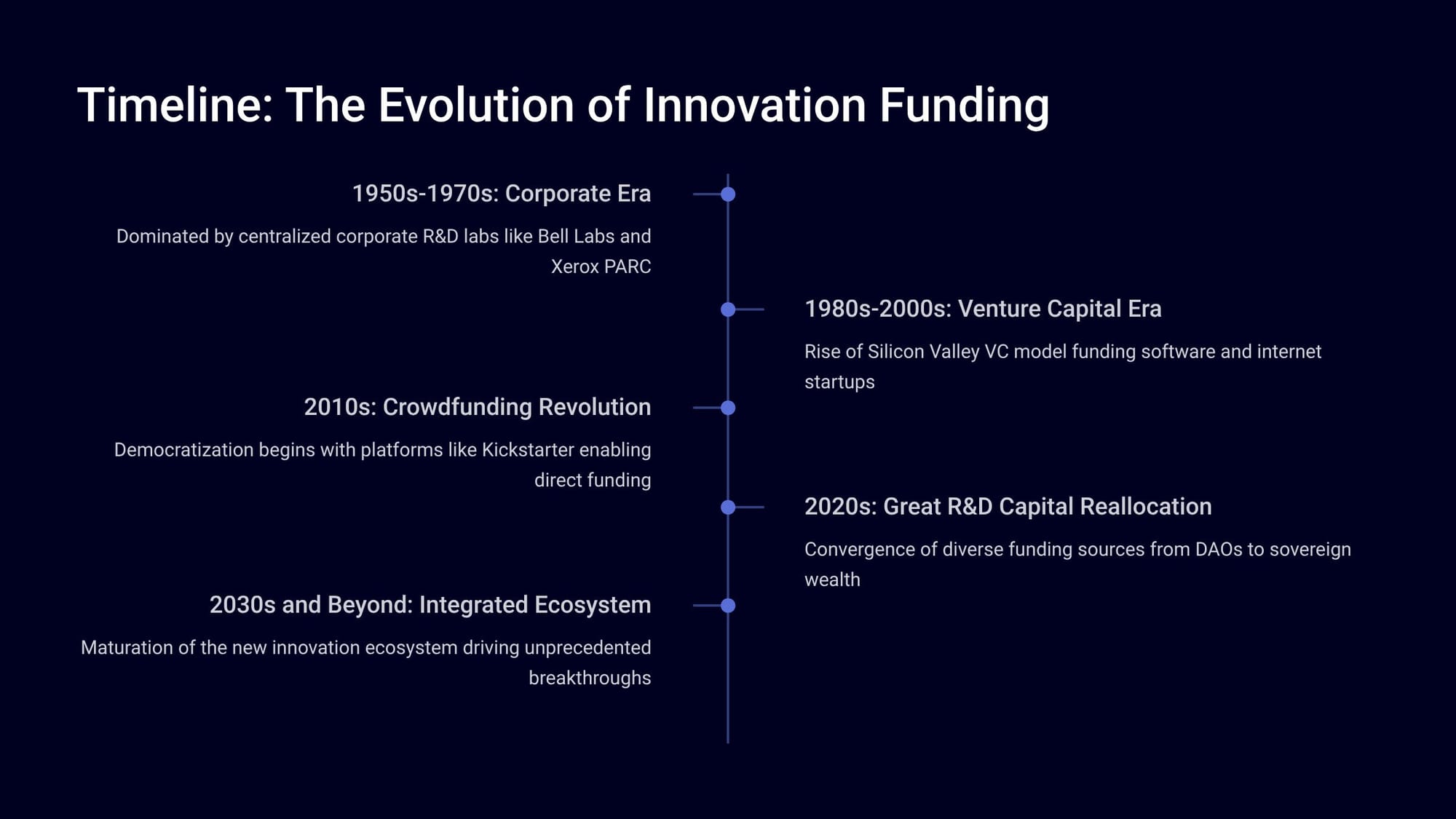

Put all of these trends into perspective with a timeline that outlines the evolution of innovation funding

- 1950s-1970s: Corporate Era: Dominated by centralized corporate R&D labs like Bell Labs and Xerox PARC

- 1980s-2000s: Venture Capital Era: Rise of Silicon Valley VC model funding software and internet startups

- 2010s: Crowdfunding Revolution: Democratization begins with platforms like Kickstarter, enabling direct funding

- 2020s: Great R&D Capital Reallocation: Convergence of diverse funding sources from DAOs to sovereign wealth

- 2030s and Beyond: Integrated Ecosystem: Maturation of the innovation ecosystem driving unprecedented breakthroughs

This is a VERY significant trend.

It was well underway through the last decade, and yet, the sudden abandonment of the future by the US in the last many months now has the impact of accelerating the impact of the trend to a huge degree. I'll tackle that issue next, when I examine "what comes next with the decline of an empire."

It's a reality that not a lot of people want to talk about or acknowledge, but that has a profound impact on our overall future.

Futurist Jim Carroll has covered the acceleration and disruption of R&D in keynotes for leading teams of organizations such as DuPont, Chemours, PPG, NASA, Sandia National Laboratories, and the US Air Force Research Laboratory.