"The global power grid is being rewired. You can either argue about the old outlets or help connect the new ones."- Futurist Jim Carroll

The massive shift from carbon combustion to electric power is transforming transportation, infrastructure, and energy supply chains. This is not a gradual transition but rather a fundamental rewiring of how power flows through our economy. Some folks have made it a culture war but that will have little impact in the long run - or will cost certain regions dearly as the future marches on.

For quite some time, I've bemoaned the fact that for a while now, obvious issues of future progress are being set back at various places in the world as they become a part of the culture wars - such as here.

But, here we are.

And the funny thing is, despite that, the rest of the world marches on.

The global shift to an electrified energy system is no longer a question of if but how fast - the transition has surpassed a critical tipping point. It's being driven by three powerful, self-reinforcing forces: superior economics, accelerating technological innovation, and entrenched market momentum. I generated a PDF that summarizes all this, which you can access here.

No doubt there are some hurdles - much of it having to do with politics, not science - those are transitory, and will be limited to nations that choose to try to go back to the way it was, not to where the rest of the world is going.

Why? At its core, the shift to electrification is fueled by powerful economic advantages.

- Cost Competitiveness: Renewables are now the cheapest source for new power generation in most markets across the globe. 81% of all new renewable capacity added worldwide in 2023 generated electricity more cheaply than the most economical fossil fuel options.

- Price Stability: With zero fuel costs, renewables offer predictable electricity prices for the long term, protecting economies from volatile fossil fuel markets. This volatility acts as a hidden tax; at its peak in 2022, rising energy prices were responsible for one-third of the 40-year high inflation in the United States.

- Externalities: The world is increasingly recognizing the hidden costs of fossil fuels, from climate damage to severe health impacts. Fossil fuel air pollution is linked to 4.5 million premature deaths annually, carrying a global economic cost of $2.9 trillion each year.

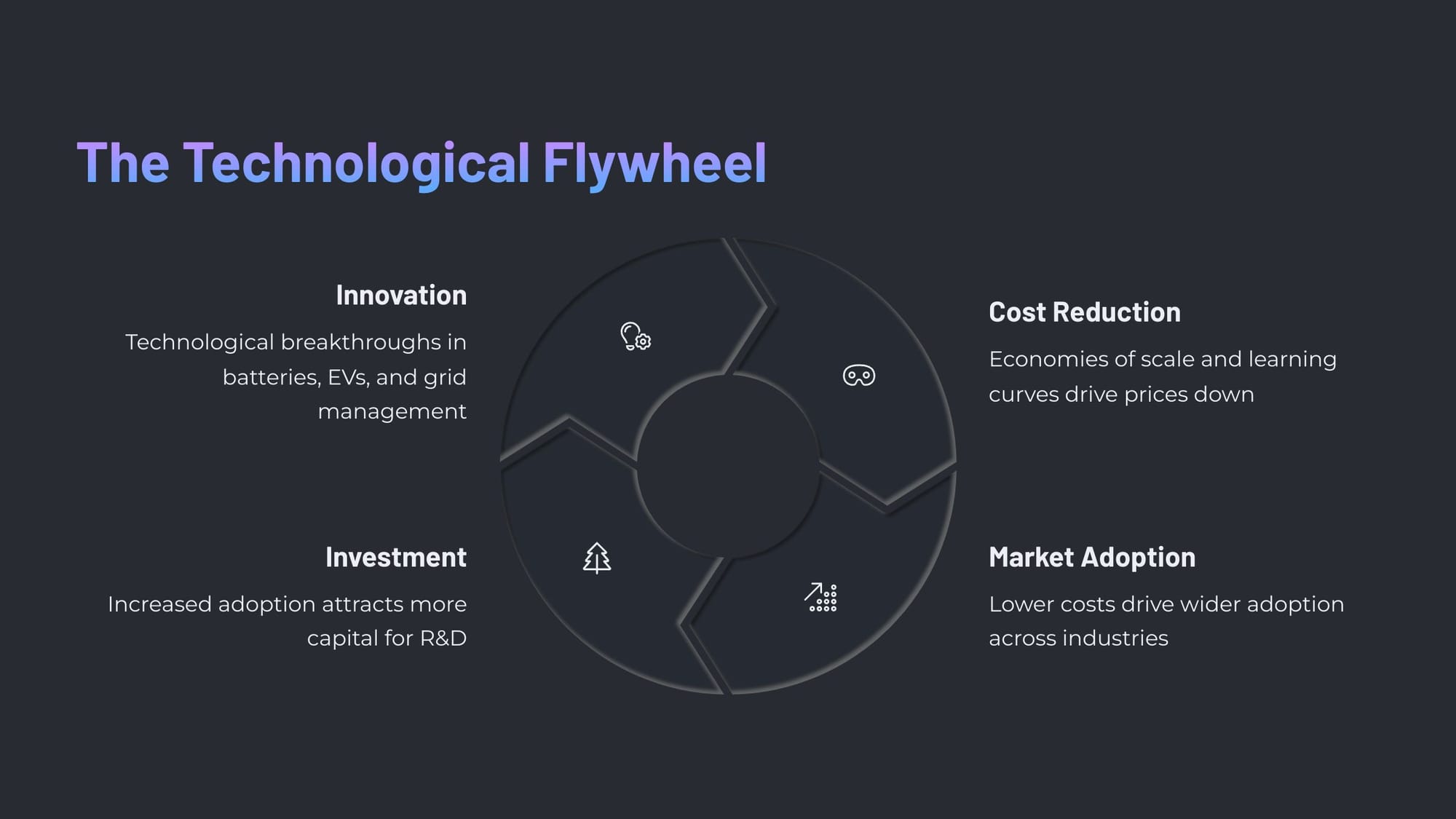

At the heart of this is a continuous cycle of innovation that accelerates the transition. Breakthroughs attract capital, which creates economies of scale, which lowers costs and drives even wider adoption. There is simply too much momentum going forward.

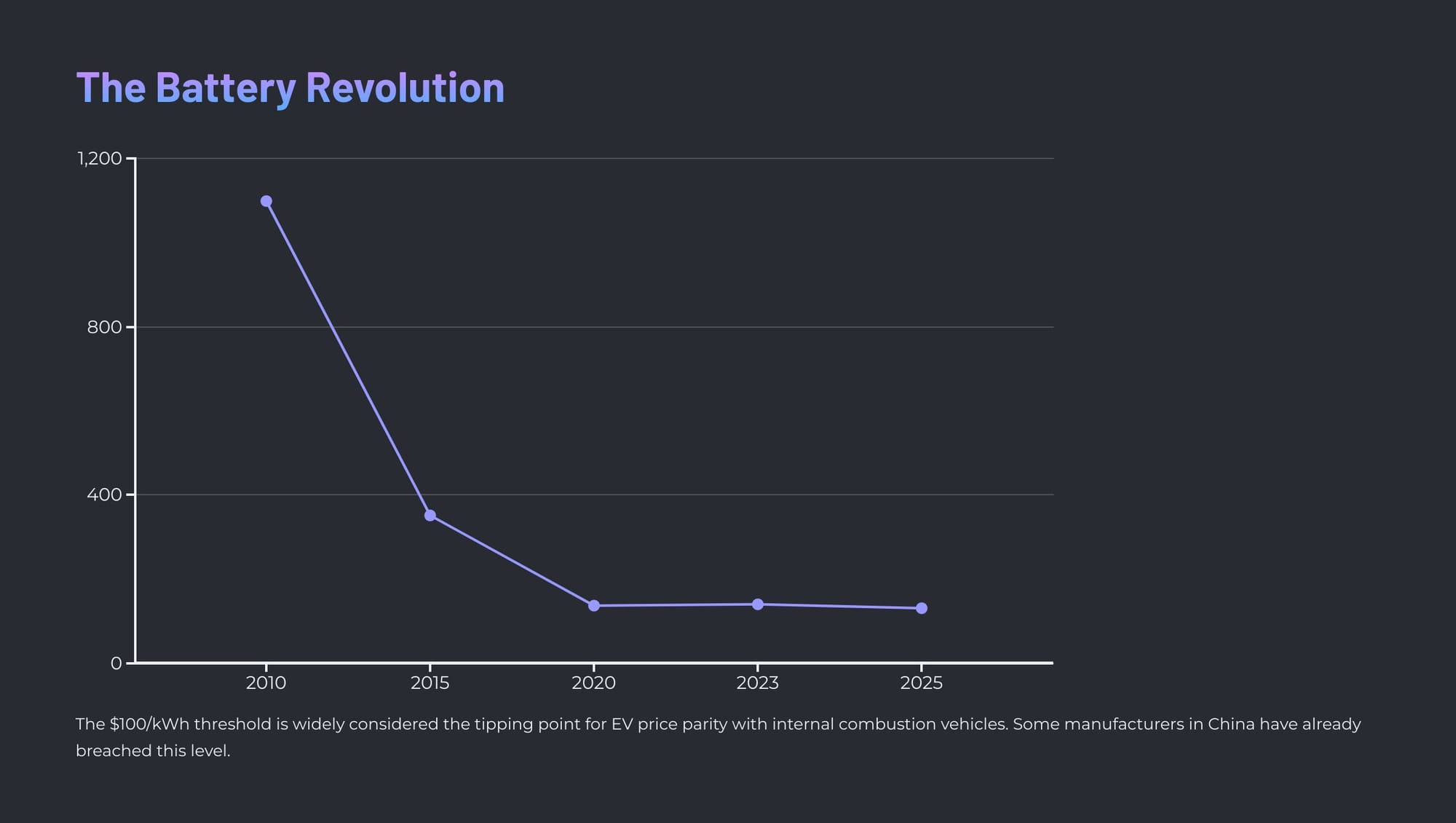

At the heart of it all? Batteries! It's the "keystone" binding the decarbonization of the transportation and power sectors. Costs have fallen dramatically, with some Chinese manufacturers already breaking the $100/kWh price point—the widely considered tipping point for making electric vehicles achieve price parity with internal combustion engine cars. This makes both affordable mass-market EVs and large-scale grid storage economically viable.

This graph tells it all:

The result is that this cost collapse has a profound impact on two major industries:

Part of this is the inevitable shift to the EV, particularly as a digital platform - the car becomes a computer, and electrification plays a key role in this. As they become digital, they offer a superior user experience with over-the-air updates, software-defined features, and lower maintenance requirements that traditional vehicles cannot easily match. Some folks have asked me recently - 'isn't the EV dead?' If you watch US politics, sure - but tell that to the rest of the world!

Then there is the intelligent grid: The grid is transforming from a passive, one-way system into an intelligent and interactive network. This is powered by AI-driven analytics, advanced smart meters, and Vehicle-to-Grid (V2G) technology that allows EVs to function as distributed energy resources.

All of this means that this energy transition has grown into a mature, self-sustaining market that is resilient to short-term political and economic cycles.

Oh, and don't forget geopolitical reality and the impact of China! Their deliberate industrial strategy has positioned it as the world's dominant producer and market for clean technologies, accounting for 60% of global EV sales and 75% of lithium-ion battery production. Quite simply, they own the future of the global automotive industry, despite some protests to the contrary.

So what does it all lead to? Massive investment - In 2024, global investment in the energy transition surpassed $2.1 trillion. New factories and jobs create powerful constituencies that make reversing course politically costly. We just saw that in the last 24 hours in the US.

Then there is corporate More than 400 major U.S. companies have committed to using 100% clean energy. These corporate climate goals are creating a "bullwhip effect" of decarbonization that cascades through their global supply chains. They are moving away from using the shift as a pure PR play to a real commitment based on economics. Money talks.

Look, I'll admit the journey is not without its challenges. These represent the "hard part of the journey" but are viewed as solvable issues, not deal-breakers. Significant investment is needed to upgrade the aging grid infrastructure. For instance, annual investment in power grids must rise from the current $390 billion to $600 billion by 2030 to meet climate goals.

There are BIG system costs - including expenses for grid reinforcement and balancing supply and demand. However, these very costs create the market opportunity for enabling technologies like batteries, smart grid software, and demand response services.

That said, the trend is not going away - and as a megatrend, is certainly one where a HUGE amount of growth and opportunity will continue to unfold.

Futurist Jim Carroll is fascinated by the fact that many people choose not to take advantage of the dramatic cost savings offered by EVs as some sort of virtuous political statement. Odd.