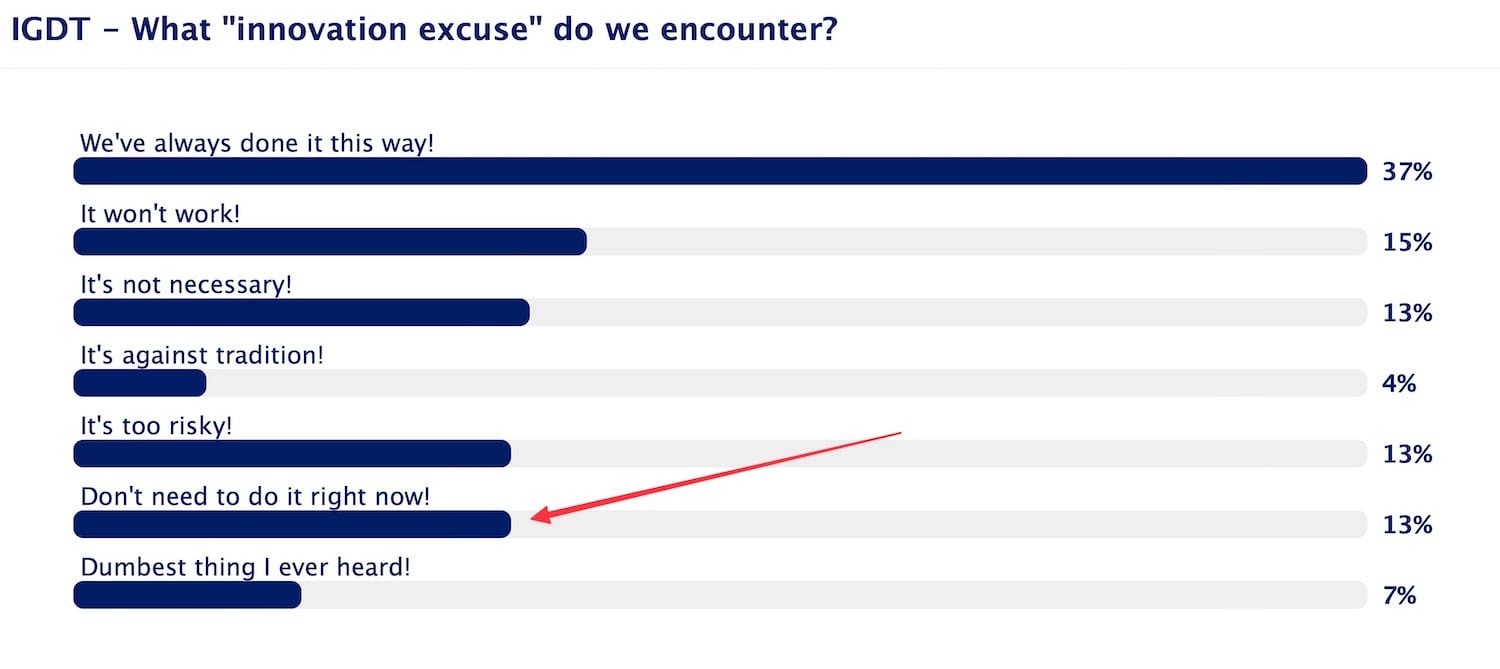

"We don't need to do it right now."

That's one of the most common responses when I poll an audience as to the innovation excesses that hold back their organization from pursuing the future. For example, here's a poll from an event I did for a team from Philips Medical, with several hundred responses coming in. The result is consistent with most of the polls I've run over the last 15 years - several hundred of them. Most people feel the biggest excuse that is in the way of creating an innovation culture is a mindset that 'we've always done it this way,' followed by an attitude that 'we don't need to do it right now.'

The most dangerous moment for any organization is when it lets a short-term focus cause it to lose sight of the necessity for long-term change and investment.

And right now, as everyone everywhere seems to be in a frozen state of indecision, it's those who dare to step away from the pack and make big, bold moves to align to tomorrow who will be the ones who will win.

I'm pretty convinced right now that in the race to an all-electric vehicle future, where cars essentially become big iPads on wheels with batteries, three organizations will clearly survive - Kia, VW, and Ford. If you watch the leadership team discussions online, observe their progress, and analyze their strategies, it's clear they are playing the long game. The rest? Myopic, short-term focused, still decisive on squeezing all they can out of today's fat margin selling big gas-guzzling trucks, with precious little investment into the reality of tomorrow.

Insurance? Progressive Insurance gets it - the new competition is real-time analytical engine insurance, with a world in which Tesla uses the connectivity of its data insight to suddenly become an automotive insurance company, not just a manufacturer. In the face of that reality, other insurance companies seemed destined to rely on their old actuarial business model of looking back in time instead of looking forward to a world of real-time insurance. John Hancock gets it with its Vitality product - a life insurance solution that is based on real-time healthcare analytics with provable lifestyle actions, rather than traditional policies that look back in time. Insurance is changing, and yet only a few are changing with it.

Change is inevitable - your indecisiveness need not be.

"We don't need to do it right now." If not now, when? What happens here? There's a stunning lack of urgency, a sense of complacency, a mindset of meandering forward. The result is a regular stream of missed opportunities, failed initiatives, and eventually, failed strategies.

You can't play the long game with short-term myopia.

This is a critical leadership issue. If a team is not given the message from the top that many decisions should be made through the lens of a longer-term focus, the myopia might begin to disappear. But if everyone sees that the top group of executives is indecisive, short-term focused, and narrow in thinking, then that mindset trickles down through the organization. I found a great article about this that spoke of the issue in terms of the transformation of financial services and the short-term myopia that is common to most big financial institutions.

I do not subscribe to ‘bank bashing’.

You don’t get a medal for deciding to transform your bank. If you get it right, you get to survive.

Although I will be the first to admit that banks have been slow in digitizing, I don’t believe that is because they are either malicious or stupid.

I rather think it’s for three reasons – three reasons I have discussed at length both in this column over the years and in my book.

The economy is digital. Banks are lagging behind. The reasons for that are complex and multifaceted but can be grouped under three rubrics:

The financial services world thought we had more time… and that the pace, direction and content of the change would be more in our control than it turned out to be. Although the digital era was never in doubt, the industry didn’t expect it to come so fast, be so all-encompassing and happen… to us… to the extent that it did.

The way banks are set up from a business perspective doesn’t lend itself to making long-term bets and planning for an open-ended horizon when making choices that affect investments into technology infrastructure, pricing and market positioning.

19th century advice for 21st century problems

20 April 2023, FinTech Futures Analysis

It's pretty clear that right now, many people do not take the future and the implications of their actions into account when making decisions. They are too focused on solving the problems of today, and spend little time about how one problem will balloon and exponentiate tomorrow. They refuse to accept the inevitability of change. They believe the status will always be quo.

They fail to anticipate accelerated change.

The result is entirely predictable.

Futurist Jim Carroll will often make a short-term decision on the golf course that he later comes to regret in terms of the long-term impact on his overall game.

Thank you for reading Jim Carroll's Daily Inspiration. This post is public so feel free to share it.