Two weeks from today, I'll be the opening keynote speaker for a conference of credit union CEOs, with a good look into the future of their industry, trends in consumer and member behavior, the new disruptive influencers that are challenging their industry, accelerating technology and more.

As with many of these events, I've had a number of advance calls with them to build and customize my talk. And as with all of these situations, I get a great sense of what's on their mind. In this case, it's not just the types of issues above, but also the current hyped trends of the day - things such as the metaverse, cryptocurrency, NFT, and other such trends that are very much in the news. This is typical for my keynotes - over the last 28 years, I've found that many of my talks have to veer into an interpretation of the current fads because FOMO - the 'fear of missing out' - runs deep.

That's why some months back, I structured together this keynote topic description, and this approach is forming a good part of my talk. As the head of the organization chatted yesterday, I made clear to him that my talk would spend less time on examing these trends in-depth, and more time on analyzing the issue of 'how can you best understand the issue of the timing of these and other trends.' If you've followed me for any length of time, you'll know that I often have a deep skepticism of the short-term reality of any trend when it enters the arena of overhype.

He agreed and loves the approach - understanding that many of the member organizations can fall prey to FOMO. With that in mind, a part of my talk will be built upon this keynote description that I pulled together some time ago.

Deciphering The Disruption: Deconstructing the Metaverse, Blockchain & Crypto, NFT's, Web 3 and More - A Reality Check for Humans!

In as little as ten years, the very concept of money might have been forever changed by crypto-currency and blockchain technology - and then again, it might not. The same might be true of all the trends that now dominate our new vocabulary - from the metaverse to NFT's, Web3 to Bitcoin. What's real, and what's not? Are we about to unleash a wave of innovation that parallels and exceeds the impact of the arrival of the Internet economy? Or are we simply being held hostage to the accelerated hype machine of Silicon Valley and venture capitalists, eager to cash in on an accelerated world of faster FOMO - "fear of missing out?"

Making sense of today's reality is a challenge, and that's where Futurist Jim Carroll comes in. As they say, timing is everything, particularly when it comes to the issue of getting involved in any particular trend. In the era of acceleration, it becomes even more critical. You’d better make sure you are ready with any trend of importance and relevance because the future might happen before you know it. And yet understanding the future today is all the more challenging as the gap between the promise and reality of any new trend becomes even more challenging when faced with opinions that are all over the map. As Kevin Kelly, the founder of Wired noted, “the future happens slowly, and then, all at once.” Any particular trend can bubble along for a time, seemingly inconsequential and of little impact. And then, all of a sudden, it can ‘go supernova’, explode in importance and significance – and suddenly, be everywhere!

In this keynote, futurist and technology expert Jim Carroll peels away the layers of the new vocabulary and today's 'hot trends', outlining the challenges and opportunities that come with a fast-moving world - and provides a real overview of the potential impact and hype behind today's trends.

As CEOs of credit unions, it's pretty clear they don't need to have their attention diverted by the latest and greatest hype - the current shiny object - but need to concentrate on the real trends that matter. They don't need to take part in the chase of the latest shiny object, while certainly understanding, experimenting, and thinking about the object - and the timing of when it might become real.

The interesting thing is that 'shiny object syndrome' has been a part of our world for many years - often driven by Silicon Valley and the technology industry - and there are a limitless number of leadership and strategy-oriented cartoons about the futility of the chase. Sadly, it's all too real, because FOMO runs deep!

What trends are worth watching as we start to enter an eventual weird, post-Covid economy? How do you distinguish real trends from fads? What really matters? Just over a year ago, I took this on in a video I filmed in my virtual broadcast studio.

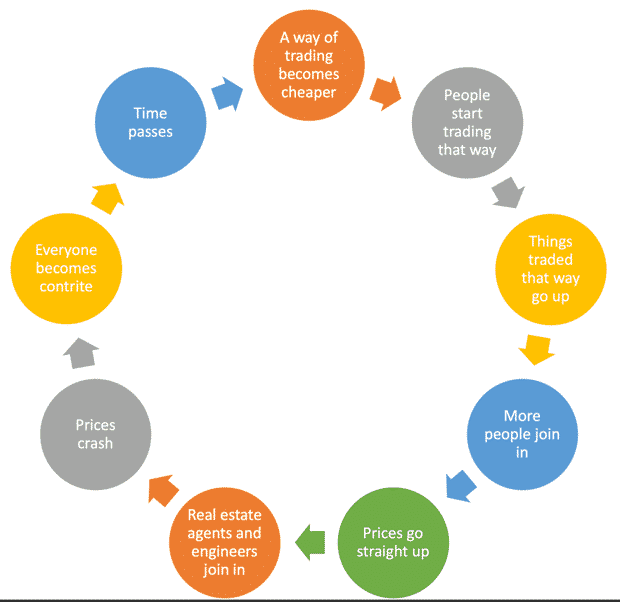

I covered a lot of stuff - fad trends like NFT (nonfungible tokens), Clubhouse, and meme-investing which are all over the news, leading to the first real trend I'm watching - the acceleration of "FOMO" - Fear of Missing Out!

Meme investing? This chart pretty much sums up that world:

In the video, after covering FOMO, I took at some of the real trends that I think are worth looking at, including the emergence of the Chief Resilience Officer, the relationship economy, space repurposing, and work back pushback, and the surplus surprise!

If you want to watch real trends - not hyped trends - this video is for you!