On February 12, 2002, United States Secretary of Defence Donald Rumsfeld answered a question at a U.S. Department of Defence (DoD) news briefing about the lack of evidence linking the government of Iraq with the supply of weapons of mass destruction to terrorist groups. His answer has since answered the lexicon of lore, as many people thought that it was fully intended to shield the department from any sort of criticism.

Reports that say that something hasn't happened are always interesting to me, because as we know, there are known knowns; there are things we know we know. We also know there are known unknowns; that is to say we know there are some things we do not know. But there are also unknown unknowns—the ones we don't know we don't know. And if one looks throughout the history of our country and other free countries, it is the latter category that tends to be the difficult ones.

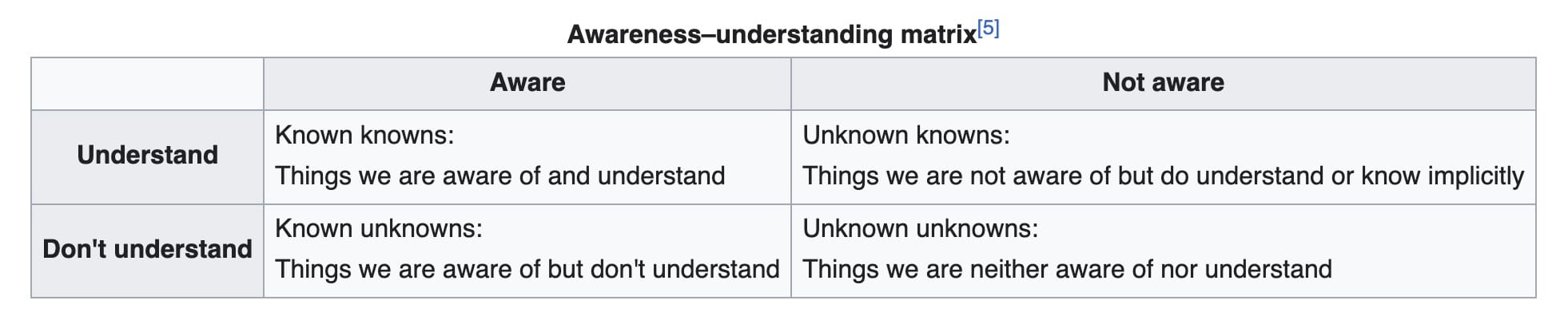

His answer, though, was based on what is known as the "Awareness-understanding matrix", which provides that there are known knowns, known unknowns, unknown knows, and unknown unknowns. Complicated but helpful - when you study it, it makes sense. Things we are aware of and understand; things we are aware of but don't understand; things we are not aware of but understand or know implicitly; and then, the things we are neither aware nor understand.

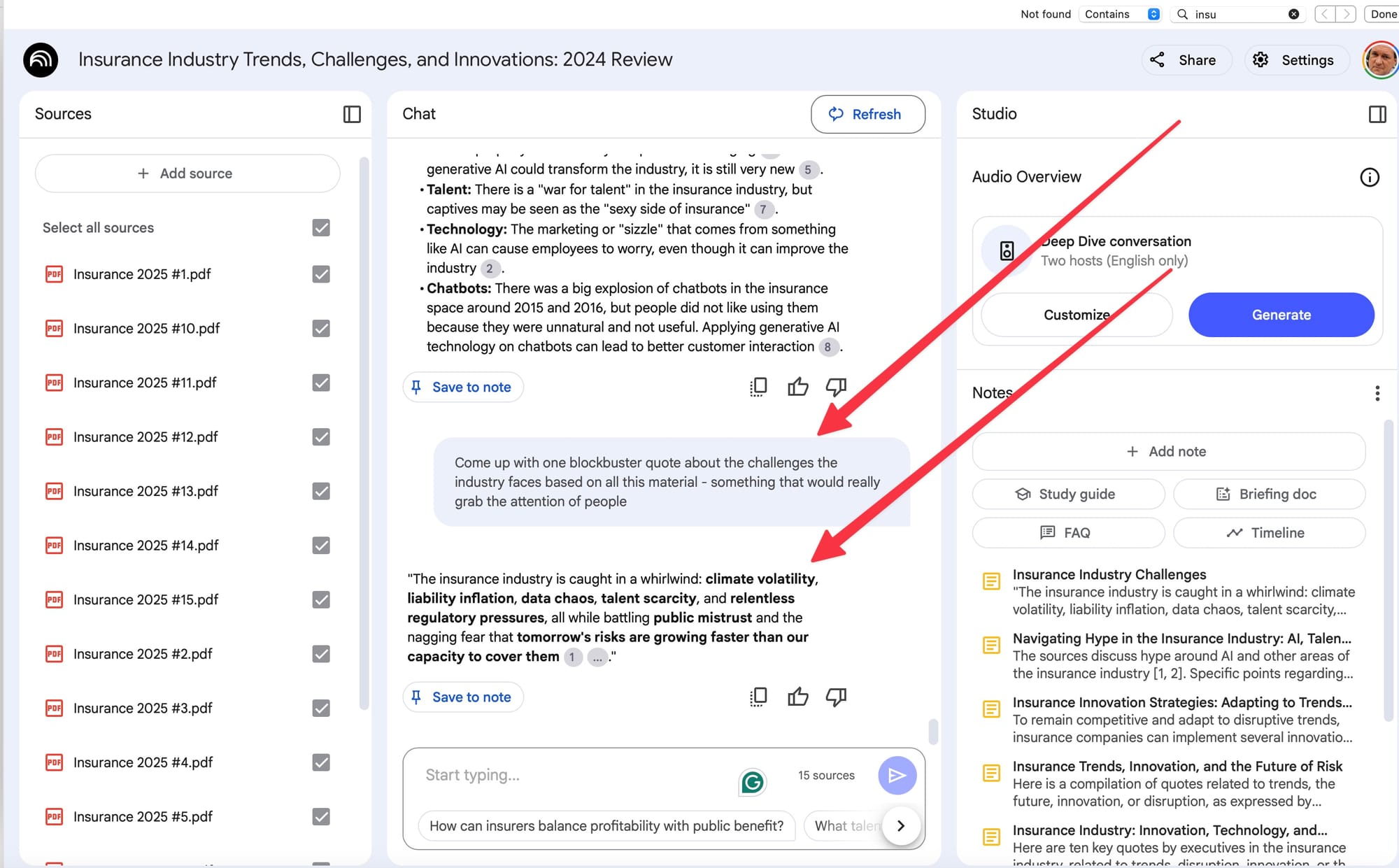

In that context, later this morning I'll speak to a room full of insurance CEOs and other senior executives from the industry at a major insurance conference. To get ready for the event, I grabbed about 1,500 articles about the latest trends impacting the insurance industry and used Google Notebook to analyze these articles for key bits of insight.

I will be speaking, among many other issues, about the future of insurance risk, and in that context, will impress upon them that it's the "unknown unknowns" they should worry about - the things they are neither aware of nor understand.

What are those unknown unknowns? In a brief moment of inspiration, I fed it this prompt, in effect asking the AI to analyze these 1500 articles and summarize them.

"Come up with a blockbuster quote about the challenges the industry faces based on all this material - something that would really grab the attention of people.

This is what it came back with, which I worked into my slide deck:

"The insurance industry is caught in a whirlwind: climate volatility, liability inflation, data chaos, talent scarcity, and relentless regulatory pressures, all while battling public mistrust and the nagging fear that tomorrow's risks are growing faster than our capacity to cover them”

That pretty much summarizes my slide deck - and the last bit pretty much summarizes the future of insurance risk!

It's a topic I've covered before, particularly in the context of these two observations:

"New technologies will now always emerge faster than the ability of organizations to manage the risk it represents!"

And this one:

"Every new technology is ultimately used for a nefarious terrible purpose, accelerating societal risk"

And it's not just the unknown risks itself - it's the speed with which new risks are coming at us!

Suffice it to say, it will be an interesting keynote!

Futurist Jim Carroll has spoken at over 200 insurance and risk-related events throughout the years.